Brazilian-Swiss bank buying BNP's emblematic building in the heart of Geneva's financial district

Banking group J. Safra Sarasin is buying a 15,000-square meter building in Geneva from BNP Paribas for

Banking group J. Safra Sarasin is buying a 15,000-square meter building in Geneva from BNP Paribas for

Who's the monkey, you ask?

There are two mainly

Perhaps it's Talmudic wisdom but, selling stocks before the eight-day span of the high holidays has avoided many declines, especially during uncertain times. While being long Yom Kippur to Passover has produced 64% more advances, half as many losses and average gains of 7.0%. This past year $DJIA gained 19.9% from Yom Kippur 2020 to Passover 2021.

Egyptian billionaire Naguib Sawiris has set up a $1.4bn fund to hold his gold mining investments and pursue new opportunities in the sector, which he says is need of consolidation.

The Luxembourg-based La Mancha Fund will be a "deep value, long-only fund" dedicated to gold mining and open to new investors, Sawiris said. The fund will also invest in battery metals needed for electric cars.

…

Sawiris said the fund would take stakes in some of these junior miners and encourage further consolidation through mergers and acquisitions. It will also seek to improve the environmental, social and governance performance of the sector and broaden its appeal.

...

The fund will hold Sawiris' stakes in Endeavour Mining, the largest gold producer in West Africa, as well as Evolution Mining, Golden Star, and Altus Strategies. It also includes a $100m investment from "a strategic partner", who was not named.

The fund will look to buy "significant stakes" in junior mining companies with "strong managerial and geological potential to implement a 3-to-5-year value creation strategy," it said.

It will also look to improve operational efficiency of mining operations and help companies expand through exploration and new mines. It will be supported by an advisory committee made up of mining professionals that will be chaired by Sawiris.

See the whole article on the FT here: https://www.ft.com/content/5cc8e9a5-3c2a-40a0-b795-e526dbb31104

Commodity traders that have reaped huge profits from the oil market in recent years now want to play a role in renewable energy.

Speaking at the FT commodities Summit in Lausanne, all the major traders reinforced their intention to continue to invest in Renewable Energy projects as they shift away from fossil fuels.

Mercuria co-founder Marco Dunand: "within five years, 50 per cent of all investments are going to be for the energy transition. We have started and have invested well over $500m."

Russell Hardy, chief executive of Vitol, the world's biggest independent oil trader, said it aimed to put half of its investments in renewables and transitional energy, such as gas. The trading house has committed over $1bn in capital for renewable projects.

Torbjörn Törnqvist, Gunvor chair, said it was increasing its investments in power trading, existing renewable technology as well as decarbonisation technologies.

Trafigura last year announced plans to build or buy 2 gigawatts of solar, wind and power storage projects over the next few years through a joint venture with fund manager IFM Investors.

…

"Every time the company invests into say an upstream [oil and gas] asset . . . we are going to have to put the equivalent money into the energy transition," Dunand said.

Unlike some of its peers, which are primarily focused on physical oil trading, Mercuria has also pushed into financing, offering clients complex services more akin to those offered by investment banks. In 2014 it bought part of JPMorgan's physical commodities trading business to bolster its operations, particularly in power markets.

Read the whole article on the FT here: Mercuria pledges half its investments to energy transition https://www.ft.com/content/06ea940a-2bfe-487a-8c50-5d8fcd402525

'It is anything but efficient or normal.' Surging corporate demand is upending global supply chains.

https://www.bloomberg.com/news/articles/2021-05-17/inflation-rate-2021-and-shortages-companies-panic-buying-as-supplies-run-short?

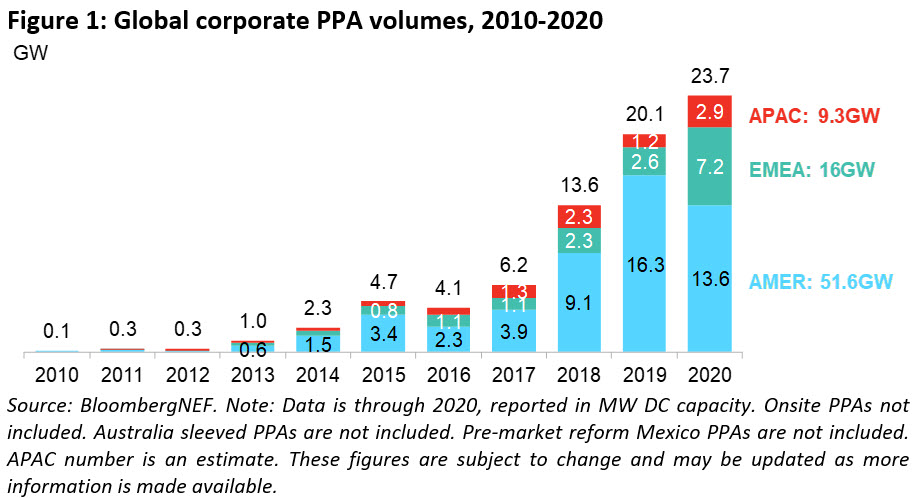

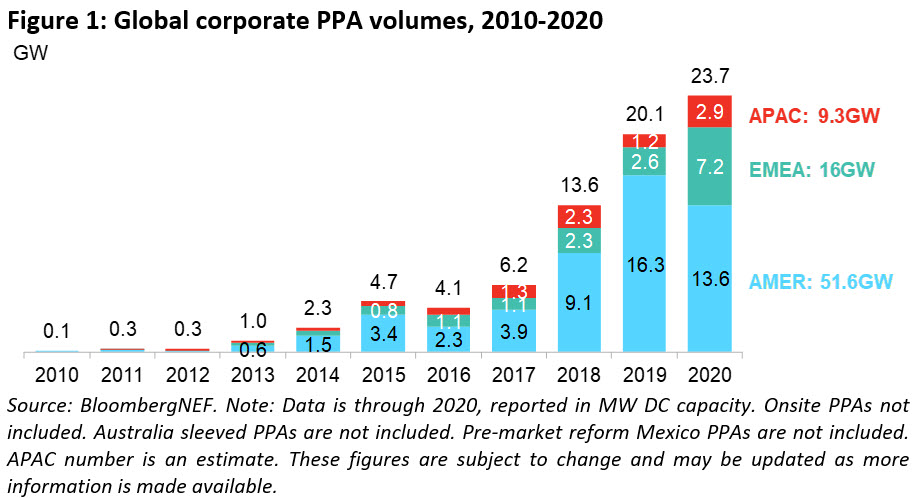

Corporations purchased a record 23.7GW of clean power through long-term agreements, propelled by growth in new markets

New York and London, January 26, 2021 – Corporations purchased a record of 23.7GW of clean energy in 2020, up from 20.1GW in 2019 and 13.6GW in 2018, according to new research published by BloombergNEF (BNEF). The increase came despite a year devastated by the Covid-19 pandemic, a global recession and uncertainty about U.S. energy policy ahead of the presidential election.

BNEF finds in its 1H 2021 Corporate Energy Market Outlook that clean energy contracts were signed by more than 130 companies in sectors ranging from oil & gas to big tech. Underpinning the market is surging stakeholder interest in corporate sustainability and expanding access to clean energy globally.

Kyle Harrison, BNEF senior associate and the lead author of the report, commented: "Corporations faced a wave of adversity in 2020 – internal corporate functions were disrupted on the outset of the pandemic, and many companies saw revenues plummet as global economies buckled. Question marks before – and after – the U.S. election further complicated long-term decision-making for companies. To not only maintain, but grow, the clean energy procurement market under these conditions is a testament to how high sustainability is on many corporations' agendas."

The U.S. was once again the largest market, but was less dominant than in previous years. Companies announced 11.9GW of corporate PPAs in the U.S. in 2020, down from 14.1GW in 2019 – the first year-on-year drop since 2016. The first half, coinciding with the start of the pandemic, was particularly subdued, with companies announcing just 4.3GW of corporate PPAs in the U.S. in that period.

Latin America also had a down year, with PPA volumes dropping from 2GW in 2019 to 1.5GW in 2020. The region was hit hard by the Covid-19 pandemic and the economic downturn. Yet companies in Brazil signed a record 1,047MW of corporate PPAs in 2020, as many continued to migrate to the country's free market, where they can sign bilateral clean energy contracts directly with developers. Once the main draw for corporate procurement in the region, Mexico saw deal volumes all but dissipate, as the current administration continues to undermine the country's clean energy sector.

While the U.S. and Latin America slipped back, other corporate procurement markets stepped up. Corporate PPA volumes in the Europe, Middle East and Africa (EMEA) region nearly tripled, from 2.6GW in 2019 to a record 7.2GW in 2020. In Spain, companies announced contracts to purchase no less than 4.2GW of clean energy, up from 300MW the previous year. Solar and wind projects in Spain yield some of the cheapest and most competitive prices in Europe, thanks to strong natural resources and a large pool of experienced developers. Companies like Total and Anheuser Busch are orchestrating 'cross-border virtual PPAs' in Spain, buying clean energy in the country to offset their load elsewhere in Europe.

Corporations also purchased record clean energy volumes in the Asia Pacific (APAC) region, announcing contracts for 2.9GW of solar and wind. Taiwan established itself as a major corporate clean energy market in 2020, with companies signing PPAs totalling 1.25GW. Taiwan's market should be supported by a new policy that requires companies with an annual load above 5MW to buy clean power. Also, the island has a high concentration of large manufacturers, many of which are feeling pressure from their customers to decarbonize.

South Korea is expected to be the next major corporate procurement market in Asia. Policymakers revised the country's Electric Utility Act in the beginning of 2021, creating a PPA mechanism and a green tariff program with Korea Electric Power Corporation. The revision will also allow companies to purchase unbundled certificates and retire them against sustainability commitments. South Korean companies face similar supply chain pressures to those in Taiwan.

Jonas Rooze, lead sustainability analyst at BNEF, said: "More than ever before, corporations have access to affordable clean energy at a global scale. Companies no longer have an excuse for falling behind on setting and working towards a clean energy target."

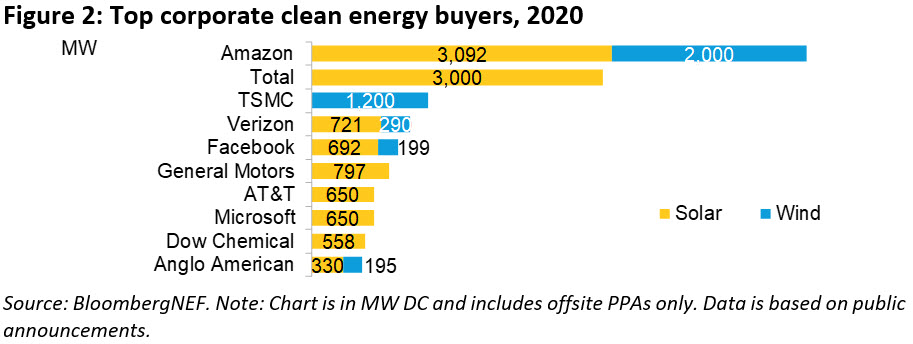

Amazon was the leading buyer of clean energy in 2020, announcing 35 separate clean energy PPAs in 2020, totalling 5.1GW. The company has now purchased over 7.5GW of clean energy to date, vaulting it ahead of Google (6.6GW) and Facebook (5.9GW) as the world's largest clean energy buyer. French oil major Total (3GW), TSMC (1.2GW) and U.S. telecom Verizon (1GW) were the next largest corporate buyers of clean energy in 2020 (see Figure 2).

The flow of new companies making clean energy commitments is another indicator of how much more the market can grow. Some 65 new companies joined the RE100 in 2020, pledging to offset 100% of their electricity consumption with clean energy. BNEF forecasts that the 285 RE100 members will collectively need to purchase an additional 269TWh of clean electricity in 2030 to meet their RE100 goals. Should this shortfall be met exclusively with offsite PPAs, it would catalyze an estimated 93GW of new, incremental solar and wind build.

Harrison commented: "Investor interest in sustainability is sky high, with inflows to sustainability-focused funds growing 300% between 2019 and 2020. Companies in all sectors, including hard-to-abate ones like oil & gas and mining, are feeling the pressure to purchase clean energy and decarbonize. This group is only just scratching the surface on the amount of clean energy build it can catalyze."

BNEF updates its data on corporate procurement each month and publishes a market outlook on corporate energy strategy bi-annually.

Contacts

Veronika Henze

BloombergNEF

+1-646-324-1596

vhenze@bloomberg.net

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.

The move may be largely symbolic as Venezuela's cash-strapped economy is in no condition to pay, and the South American nation's overseas assets are protected from seizure by U.S. sanctions. Still, the acceleration foretells a legal battle that's brewing over the country's $60 billion of defaulted debt as well as the state oil giant's Houston-based subsidiary Citgo.

"It's basically a frustration," said Russ Dallen, managing partner at Caracas Capital in Miami. Bondholders are looking at "the possibility of getting a court judgment and getting those Venezuelan assets as everyone is getting in line, trying to get a piece of Citgo and lock in a judgment from a U.S. court."

...

In September, a New York judge ruled that the country owes $390.7 million to Pharo Management and Casa Express Corp in overdue arrears, rejecting claims by the nation's representatives to delay the payment. The following month, London-based hedge fund Altana Wealth Ltd sued over defaulted debt. Bondholders have already accelerated on Venezuela's notes due in 2034.

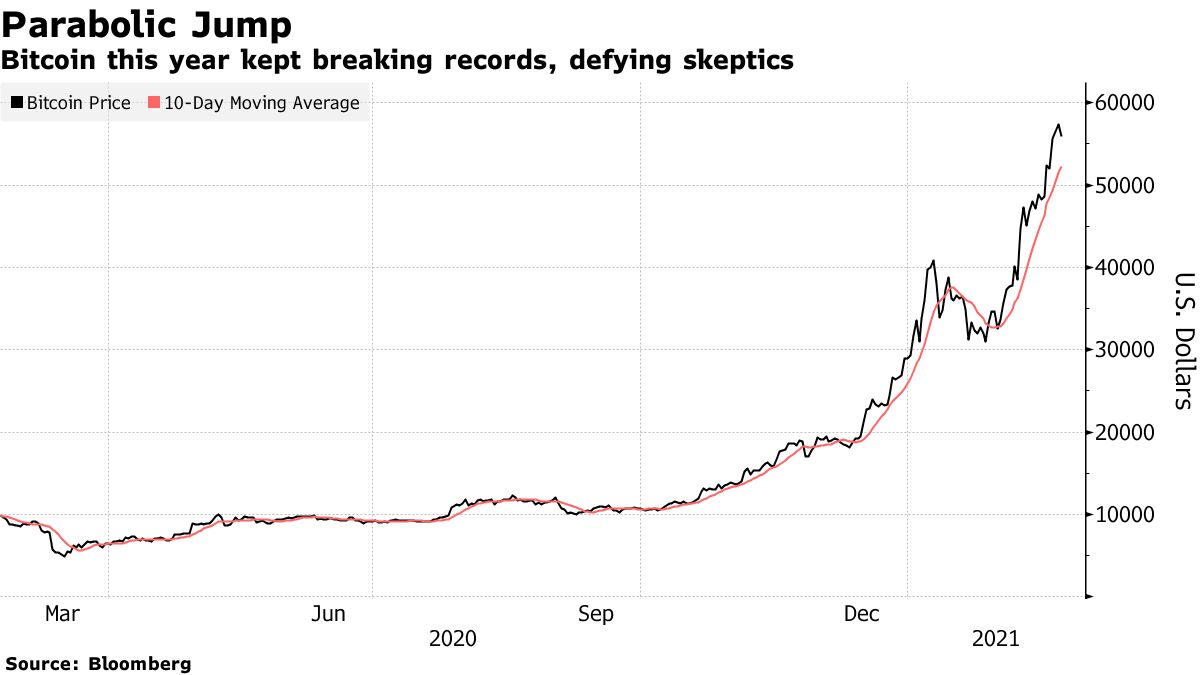

Bitcoin rose as high as $58,350 on Sunday before retreating to about $56,200 as of 2:30 p.m. in Tokyo on Monday. The token has roughly tripled in the past three months but its liquidity has deteriorated, according to Nikolaos Panigirtzoglou, a strategist at JPMorgan Chase & Co.

"Market liquidity is currently much lower for Bitcoin than in gold or the S&P 500, which implies that even small flows can have a large price impact," he wrote in a note on Friday.

Such a backdrop opens up the possibility of sharp moves higher or lower in the cryptocurrency depending on the prevailing ardor for digital assets. Of late, even some of the token's biggest backers appear surprised by its ascent. In a recent tweet, Elon Musk said Bitcoin prices "seem high," having earlier called it a "less dumb" version of cash.

Bitcoin trading volumes are around $10 billion daily for the spot and futures market combined, compared with an equivalent figure of $100 billion for gold, Panigirtzoglou wrote. That's consistent with "much lower liquidity in Bitcoin than in gold," he said.

Cryptocurrencies have enjoyed a strong start to the year, leaving other assets in the dust. The Bitcoin faithful argue corporate treasurers and institutional investors are new sources of demand and that the token can hedge risks such as faster inflation. Others see a prime example of speculative froth stoked by hedge funds and day traders in markets awash with stimulus.

"Bitcoin seems impervious to the barrage of fear, uncertainty and doubt waged against the industry," Paolo Ardoino, chief technology officer at cryptocurrency exchange Bitfinex, wrote in an email.

Shares of Asian cryptocurrency stocks advanced Monday in the wake of Bitcoin's all-time high. One of the biggest movers was Japan's Monex Group Inc., which jumped as much as 16%.

Ether, the largest token after Bitcoin, also rallied over the weekend, topping $2,000 for the first time on Saturday. It's up about 150% year-to-date.

See the piece on Bloomberg here:

In the post-Covid-19 era, it appears that no one will worry much about fiscal prudence. Instead, there is every chance that the fashion for the government to fill individuals' pockets will continue; that the endless promises of green transformation and infrastructure revolution will come good; and, crucially, that governments will prioritise high levels of employment over low levels of inflation. Think of the volume of cash that will spray around economies, and perhaps we are moving into something of a "Keynesian golden age" says Gavekal Research.

All this is wonderful for industrial metals and particularly wonderful for any materials that are at the core of green transformation. There is, for example, no replacement for copper in electrification. The more you think green, the more you need brown metal.

See the article by Merryn Somerset Webb, editor-in-chief of MoneyWeek (Twitter: @MerrynSW ), on the FT here:

Some 25 years after its founding, the firm -- its assets headed to a mere $350 million or so by the end of March -- on Sunday filed for bankruptcy protection in New York

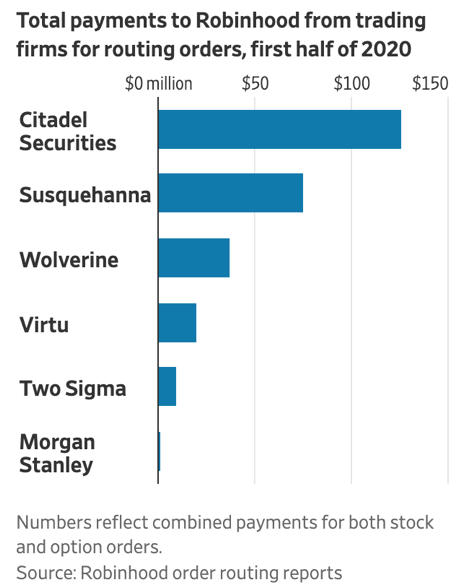

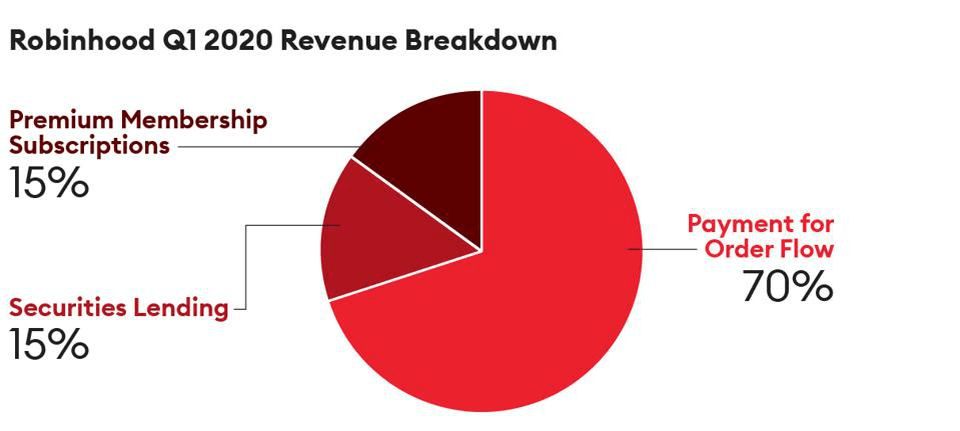

Some 25 years after its founding, the firm -- its assets headed to a mere $350 million or so by the end of March -- on Sunday filed for bankruptcy protection in New YorkRobinhood earns a majority of its revenue from Payment for Order Flow, with Citadel, Susquehanna and Wolverine accounting for more than 35% of overall revenue.

Robinhood's Revenue streams:

Premium subscriptions: Provides basic features like- Research reports from Morningstar, Level 2 quotes, Increase your instant deposit limit, Extended hours trading (pre-market and after hours), $1,000 of additional margin.

Securities Lending: Let’s its traders use margins in order to trade

Payment for Order Flow: Sells the order flow to bigger operators like Citadel, Point72, and others.

Robinhood has definitely democratized investing but this quote from a Forbes article perfectly encapsulates the other side of the story: “In fact, an analysis reveals that the more risk Robinhood’s customers take in their hyperactive trading accounts, the more the Silicon Valley startup profits from the whales it sells their orders to. And while Robinhood’s successful recruitment of inexperienced young traders may have inadvertently minted a few new millionaires riding the debt-fueled bull market, it is also deluding an entire generation into believing that trading options successfully is as easy as leveling up on a video game.”

It seems like Robinhood has sold the story of helping the average investor but its business model does the exact opposite: sells the little guy to rich market operators with very sharp elbows. This has also landed Robinhood in some regulatory trouble around not being able to fulfill the promise of best execution of the trades while selling the order flow. This has not caused huge troubles till now but can be fairly controversial as the company grows further.

Revenue Diversification

Robinhood earns a majority of its revenue from PFOF which again consolidated in a couple of customers. As shown in the graph Citadel, Susquehanna and Wolverine account for more than 35% of overall revenue. I believe that Robinhood must try to capitalize on its huge user base to diversify its overall revenue profile through premium subscription and securities lending. I believe that this could be achieved if Robinhood starts spending more resources on overall customer education and service. This would kill two birds with one stone as it would decrease regulatory burdens and increase user’s engagement with other paid features hence provide increased stability.