Iamgold (

TSX: IMG;

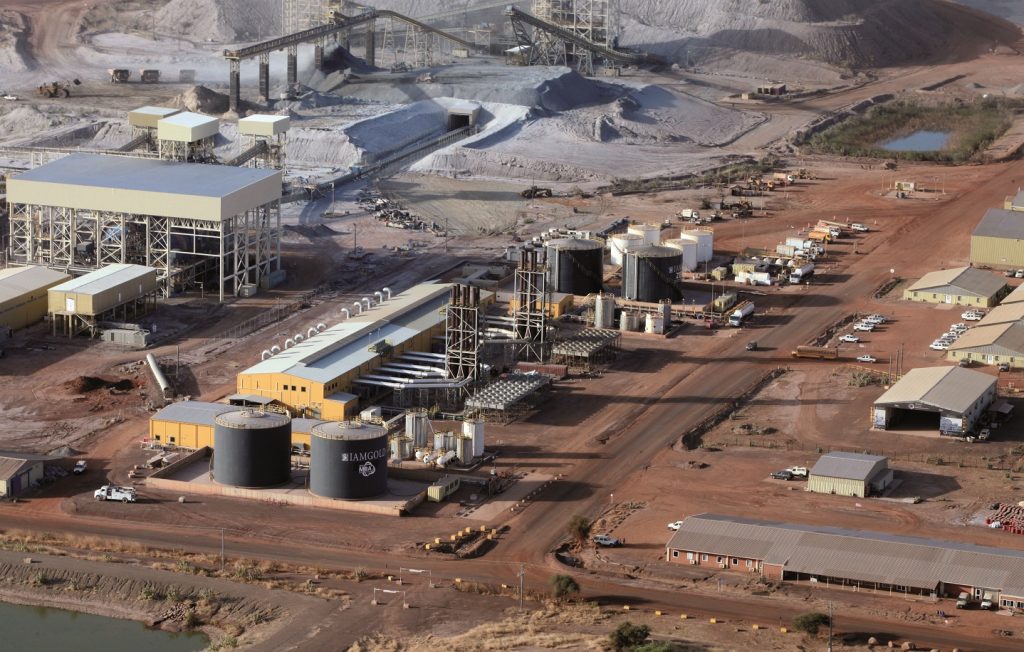

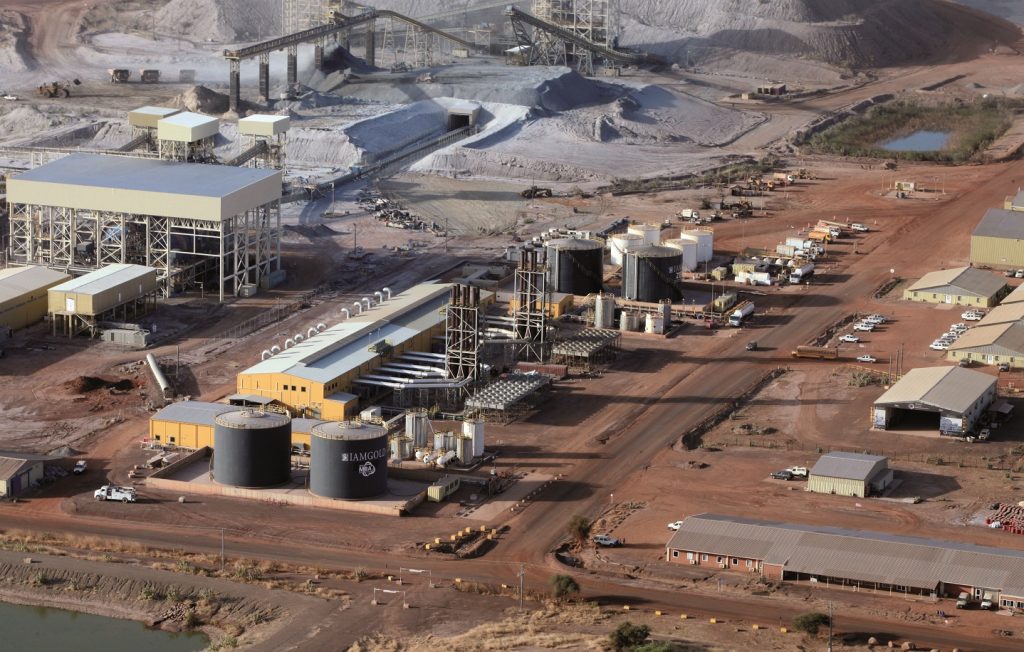

NYSE: IAG) operates in extremely remote regions of the world, and with mining a highly power intensive business, energy is not something we take for granted. Our Essakane gold mine in Burkina Faso is located in an extremely remote area of the Sahel region, 330 km away from the national electricity grid in the capital city of Ouagadougou, with no connecting transmission line.

Africa is a land greatly deprived of electricity. Total installed grid capacity on the African continent is less than in the country of Spain. With the exception of South Africa, 70% of the sub-Saharan population, or 600 million people, do not have access to grid electricity.

At Essakane, the demand for power is increasing as we mine the hard rock deep within the pit. Our power plant runs on heavy fuel oil (HFO) and our mining fleet on diesel. Power from HFO has accounted for as much as 30% of our operating costs, although less so today with the decline in oil prices.

For several years we have explored options for reducing our reliance on oil to run our operations, including increasing our use of renewable sources of energy.

After the steep decline in the oil price in mid-2014, people questioned whether renewable energy projects were still worth it. My answer to that is: Oil prices should not be the only factor — we have to think long term.

Maintaining a social license to operate is important, so constructing a sustainable power infrastructure that will benefit the communities in which we operate is important when evaluating the returns from renewable energy projects.

Renewable energy projects are not new to Iamgold. In 2014 we built a 5 MW solar power plant at our Rosebel gold mine in Suriname. It is the country's first renewable source of energy, and when we're gone it will be left for the people of Suriname.

We are now eager to embark on a second solar power project at Essakane, but on a much larger scale. The plan is to have a 15 MW solar power plant financed, developed, operated and owned by a private renewable energy company experienced in building solar energy projects in Africa.

The integration of a solar plant with our existing 57 MW thermal power plant would make this the largest hybrid project in West Africa, if not in the world.

In production for six years, Essakane is our largest gold mine, expected to produce between 365,000 and 375,000 oz. gold in 2016. Based on current reserves and resources, we expect production to continue through to 2025.

Two production lines, primary and secondary crushers, semi-autogenous grinding (SAG) and ball mills and leach tanks run 24 hours a day, seven days a week, to process more than 12 million tonnes of ore a year. The thermal power plant consists of 11 generators which operate on HFO that is trucked to the site from the nearby countries of Benin and Togo.

The mining fleet — comprising 30 haul trucks, 13 drill rigs, 9 loading units and an ancillary fleet of 25, including bulldozers and excavators — is powered by diesel, or light fuel oil, that is also trucked to the site.

The deeper we mine in the pit, the higher the proportion of hard rock. In 2012, the percentage of hard rock in the ore mix was less than 10%. We're mining little soft rock today and expect hard rock to account for nearly 100% of the mill feed in 2017. This is based on current mine plan estimates, so it could change somewhat as exploration at Essakane succeeds in securing sources of soft rock within the vicinity of the Essakane mill.

To accommodate an increasing proportion of hard rock, Essakane underwent a major expansion from 2012 to 2013. The power plant was expanded, a new pre-crushing circuit and ore handling system were added, along with a new SAG mill, ball mill and leach tanks.

As the amount of hard rock in the mill feed increases, so does the demand for energy. Hard rock can take three to four times more power to crush and grind than soft rock.

The 57 MW thermal power plant at Iamgold's Essakane gold mine in Burkina Faso. The plant consists of 11 generators which operate on heavy fuel oil trucked in from Benin and Togo. Credit: Iamgold.