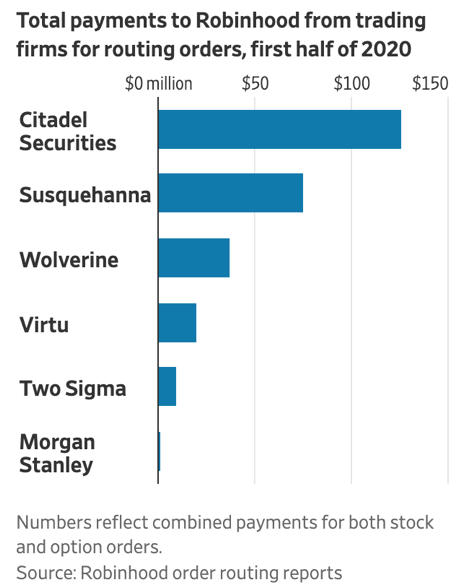

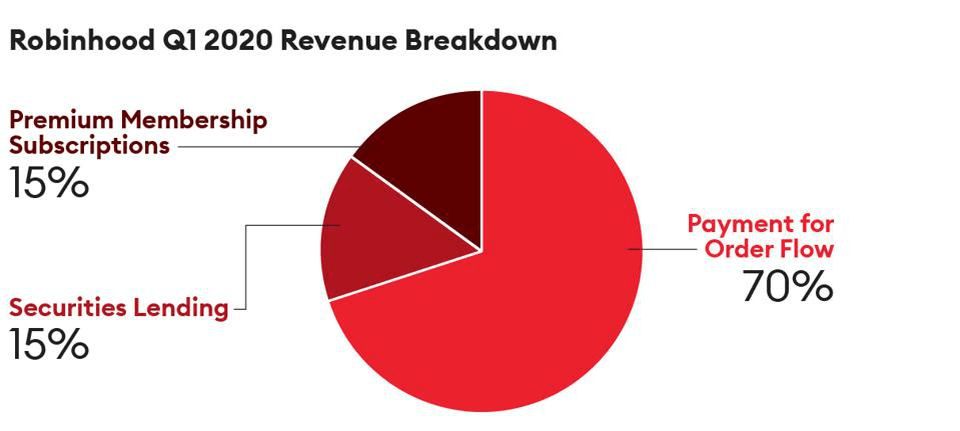

Robinhood earns a majority of its revenue from Payment for Order Flow, with Citadel, Susquehanna and Wolverine accounting for more than 35% of overall revenue.

Robinhood: Rise Of The Retail Investor

Robinhood's Revenue streams:

Premium subscriptions: Provides basic features like- Research reports from Morningstar, Level 2 quotes, Increase your instant deposit limit, Extended hours trading (pre-market and after hours), $1,000 of additional margin.

Securities Lending: Let’s its traders use margins in order to trade

Payment for Order Flow: Sells the order flow to bigger operators like Citadel, Point72, and others.

Robinhood has definitely democratized investing but this quote from a Forbes article perfectly encapsulates the other side of the story: “In fact, an analysis reveals that the more risk Robinhood’s customers take in their hyperactive trading accounts, the more the Silicon Valley startup profits from the whales it sells their orders to. And while Robinhood’s successful recruitment of inexperienced young traders may have inadvertently minted a few new millionaires riding the debt-fueled bull market, it is also deluding an entire generation into believing that trading options successfully is as easy as leveling up on a video game.”

It seems like Robinhood has sold the story of helping the average investor but its business model does the exact opposite: sells the little guy to rich market operators with very sharp elbows. This has also landed Robinhood in some regulatory trouble around not being able to fulfill the promise of best execution of the trades while selling the order flow. This has not caused huge troubles till now but can be fairly controversial as the company grows further.

Revenue Diversification

Robinhood earns a majority of its revenue from PFOF which again consolidated in a couple of customers. As shown in the graph Citadel, Susquehanna and Wolverine account for more than 35% of overall revenue. I believe that Robinhood must try to capitalize on its huge user base to diversify its overall revenue profile through premium subscription and securities lending. I believe that this could be achieved if Robinhood starts spending more resources on overall customer education and service. This would kill two birds with one stone as it would decrease regulatory burdens and increase user’s engagement with other paid features hence provide increased stability.