Moscow has been actively buying up gold this year, adding more than 96 tonnes since the beginning of 2019.

Russia bought 200,000 in May, 550,000 ounces in April, 600,000 ounces in March, one million ounces in February, and 200,000 ounces in January.

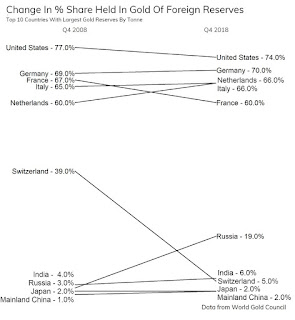

During the last decade, Russia's gold reserves have gone from 2% to 19% as of the end of 2018 Q4, according to the World Gold Council's data.

The World Gold Council (WGC) has been pointing to an overarching trend towards gold, noting that central banks around the world purchased a total of 651.5 tonnes of gold last year — the largest amount since 1971.

See the full article from Kitco News here: https://www.kitco.com/news/2019-07-23/Russia-s-Total-Gold-Reserves-Top-100-Billion-As-Central-Bank-Adds-Another-600K-Ounces-In-June.html