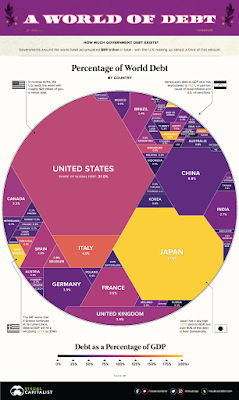

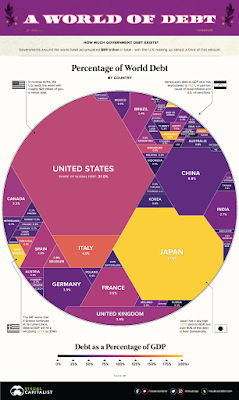

Two decades ago, total government debt was estimated to sit at $20 trillion.

Since then, according to the

latest figures by the IMF, the number has ballooned to $69.3 trillion with a debt to GDP ratio of 82% — the highest totals in human history.

Which countries owe the most money, and how do these figures compare?

The Regional Breakdown

Let’s start by looking at the continental level, to get an idea of how world debt is divided from a geographical perspective:

| Region | Debt to GDP | Gross Debt (Millions of USD) | % of Total World Debt |

|---|

| World | 81.8% | $69,298 | 100.0% |

|---|

| Asia and Pacific | 79.8% | $24,120 | 34.8% |

| North America | 100.4% | $23,710 | 34.2% |

| Europe | 74.2% | $16,225 | 23.4% |

| South America | 75.0% | $2,699 | 3.9% |

| Africa | 56.9% | $1,313 | 1.9% |

| Other | 37.1% | $1,231 | 1.8% |

In absolute terms, over 90% of global debt is concentrated in North America, Asia Pacific, and Europe — meanwhile, regions like Africa, South America, and other account for less than 10%.

This is not surprising, since advanced economies hold most of the world’s debt (about 75.4%), while emerging or developing economies hold the rest.

World Debt by Country

Now let’s look at individual countries, according to data released by the IMF in October 2019.

It’s worth mentioning that the following numbers are representative of 2018 data, and that for a tiny subset of countries (i.e. Syria) we used the latest available numbers as an estimate.

https://www.visualcapitalist.com/69-trillion-of-world-debt-in-one-infographic/

________________________

bit.ly/PangeaBlog

bit.ly/PangeaFeeds