Incrementum just published the In Gold We Trust Report, the gold standard in gold research.

Key Takeaways

• Monetary policy normalization has failed

We had formulated the failure of monetary policy normalization as the most likely scenario in our four-year forecast in the In Gold We Trust report 2017. Our gold price target of > USD 1,800 for January 2021 for this scenario is within reach.

• The coronavirus is the accelerant of the overdue recession

The debt-driven expansion in the US has been cooling off since the end of 2018. Measured in gold, the US equity market reached its peak more than 18 months ago. The coronavirus and the reactions to it act as a massive accelerant.

• Debt-bearing capacity is reaching its limits

The interventions resulting from the pandemic risk are overstretching the debt sustainability of many countries. Government bonds will increasingly be called into question as a safe haven. Gold could take on this role.

• Central banks are in a quandary when it comes to combating inflation in the future

Due to overindebtedness, it will not be possible to combat nascent inflation risks with substantial interest rate increases. In the medium-term inflationary environment, silver and mining stocks will also be successful alongside gold.

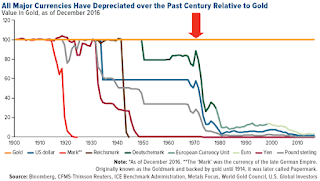

• Dawn of a new monetary world order

In the decade that has just begun, trend-setting monetary and geopolitical upheavals are to be expected. Gold will once again play an important role in the new monetary world order as a stateless reserve currency.

• New gold all-time highs are only a matter of time

The question is not whether the gold price will reach new all-time highs, but how high these will be. We are convinced that gold will prove to be a profitable investment over the course of this decade and will provide stability and security in any portfolio.

________________________

Bit.ly/PangeaBlog

Bit.ly/PangeaFeeds