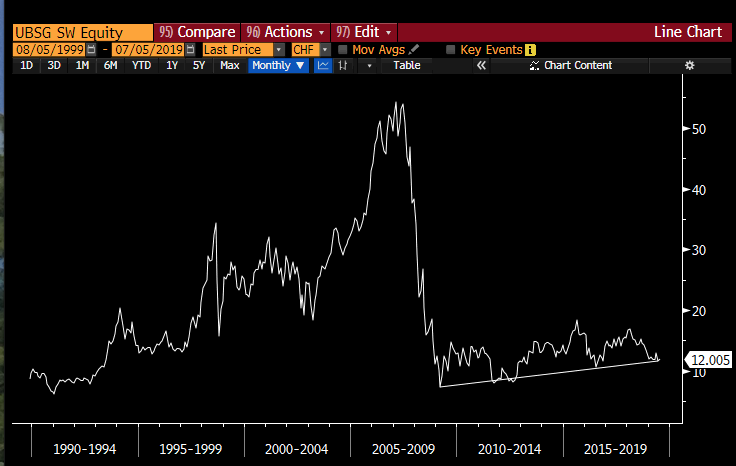

They've tried mergers. Fail. They are trying bad bank. Not sure it will get done yet. And now they are trying restructuring. Too late/no time. Meanwhile, the ECB will push yields lower, putting $DB closer to the End Game. How else can they fight a recession? They cant use fiscal

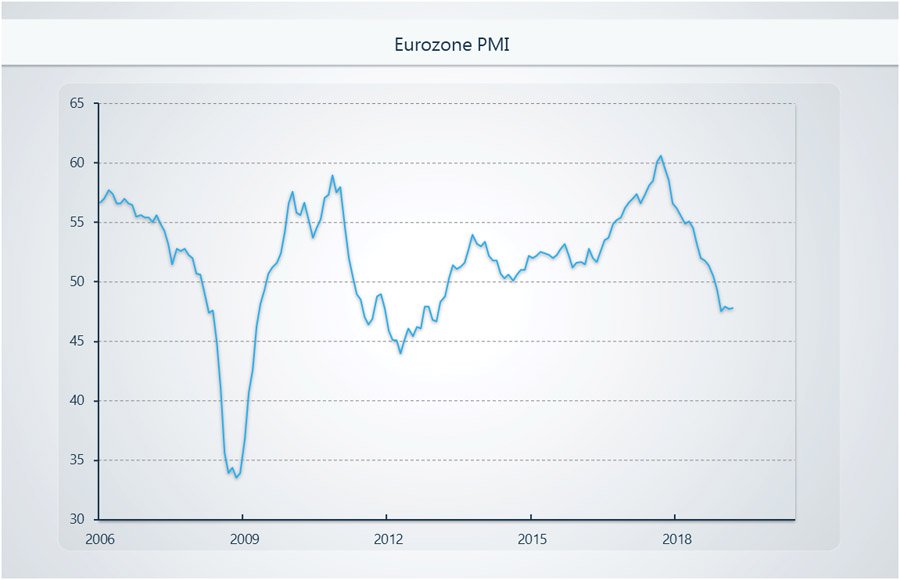

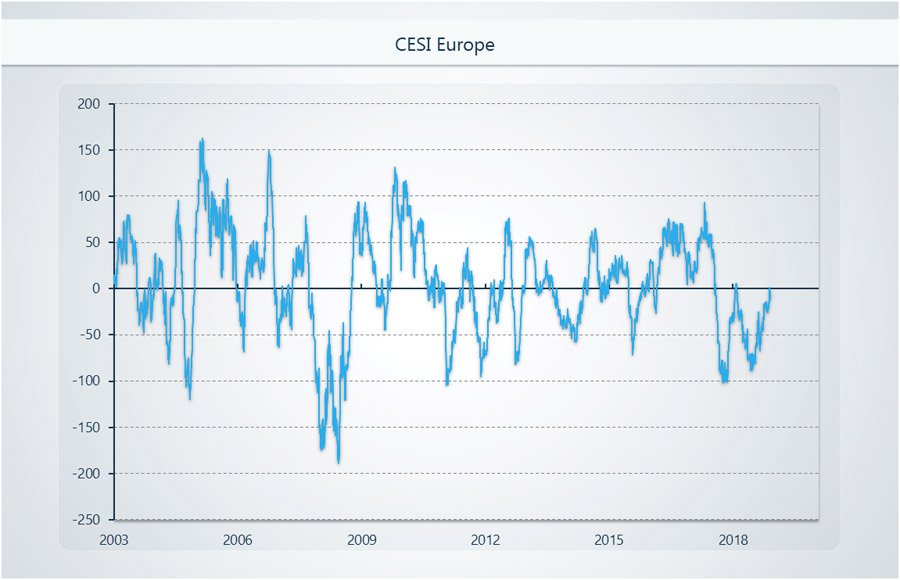

So, the knock on effects are all lining up to push one bank after another of the Cliff of Death...and there ain't a thing the ECB can do about it, as they have only one mandate - inflation. They HAVE TO cut rates. And this is why Christine Lagarde has been brought in...

The ECB is going to need to become political. It is going to have to rescue an EU-wide banking system and put the banks into state hands and buy the extra gov debt and they are going to need to force fiscal reforms and massive fiscal stimulus. They will use the situation to force

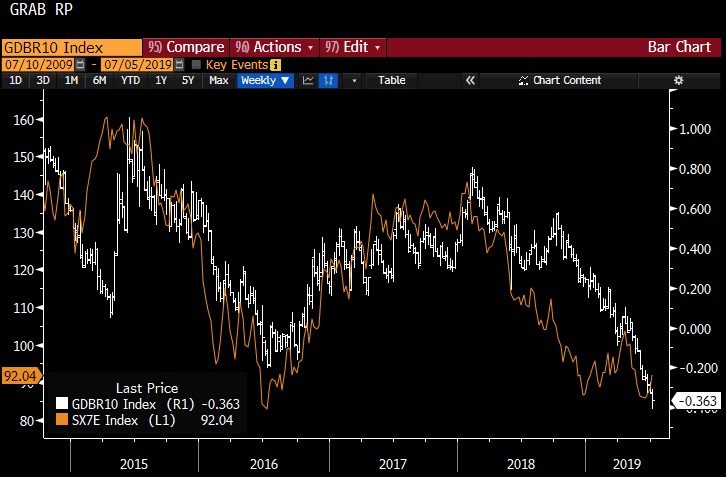

through tighter EU fiscal consolidation, maybe even leaving some nations behind. Lagarde is perfect for this. It's what the IMF does. She is also a lawyer and a politician. The problem is, this stuff takes time. The ECB will buy any credit instrument to avoid capital

markets seizing up but shareholders are going to sense an equity wipeout over the debt holders, so equities bear the brunt of it (and bunds go more negative). The dollar will get bid as the $ funding crisis can not easily be solved by the ECB and lending at the margin tightens

And a strong dollar would destroy the banks and the global economy. It's all very circular and there are very few circuit breakers. Throw in heightened trade wars between EU/US (highly likely) and China/EU/US and you have a very big issue. And my problem with all of this

It's that the probability is much much higher than I'd like. And that is the reason to own bonds, dollars, bitcoin and gold. The former two are the beneficiaries of current needs, and the latter two are the high-gamma options on this escalating into an extreme policy event.

This all needs to be watched very closely. I am concerned that the summer will end with a building sense of crisis. You can already see the signs as liquidity issues come to the fore.. (Woodford, H20). None of this is a certain but the odds are exploding.

No comments:

Post a Comment

Commented on

The Pangea Advisors Blog

Pangea on X