Great piece on the use of solar for Mining at Iamgold's Essakane mine in Burkina Faso

http://www.northernminer.com/environment/commentary-powering-iamgolds-essakane-mine-burkina-faso-solar/1003782352/?utm_source=NM&utm_medium=email&utm_campaign=NM-EN01162017&e=xr20y4rW20w0380wx8w8w69vpsw0yM2vx

— Stephen J.J. Letwin has been president and CEO of Toronto-based gold miner IAMGOLD since 2010. Prior to joining Iamgold, he held senior positions at Enbridge, TransCanada Energy, TransCanada Pipelines, Numac (Westcoast Energy), and Encor Energy. He holds an MBA from the University of Windsor, is a Certified General Accountant, a graduate of McMaster University (B.Sc., Honors), and a graduate of the Harvard Advanced Management Program.

— Stephen J.J. Letwin has been president and CEO of Toronto-based gold miner IAMGOLD since 2010. Prior to joining Iamgold, he held senior positions at Enbridge, TransCanada Energy, TransCanada Pipelines, Numac (Westcoast Energy), and Encor Energy. He holds an MBA from the University of Windsor, is a Certified General Accountant, a graduate of McMaster University (B.Sc., Honors), and a graduate of the Harvard Advanced Management Program.

Commentary: Powering Iamgold's Essakane mine in Burkina Faso with solar - The Northern Miner

By: Stephen J.J. Letwin, Special to The Northern Miner

Iamgold (TSX: IMG; NYSE: IAG) operates in extremely remote regions of the world, and with mining a highly power intensive business, energy is not something we take for granted. Our Essakane gold mine in Burkina Faso is located in an extremely remote area of the Sahel region, 330 km away from the national electricity grid in the capital city of Ouagadougou, with no connecting transmission line.

Africa is a land greatly deprived of electricity. Total installed grid capacity on the African continent is less than in the country of Spain. With the exception of South Africa, 70% of the sub-Saharan population, or 600 million people, do not have access to grid electricity.

At Essakane, the demand for power is increasing as we mine the hard rock deep within the pit. Our power plant runs on heavy fuel oil (HFO) and our mining fleet on diesel. Power from HFO has accounted for as much as 30% of our operating costs, although less so today with the decline in oil prices.

For several years we have explored options for reducing our reliance on oil to run our operations, including increasing our use of renewable sources of energy.

After the steep decline in the oil price in mid-2014, people questioned whether renewable energy projects were still worth it. My answer to that is: Oil prices should not be the only factor — we have to think long term.

Maintaining a social license to operate is important, so constructing a sustainable power infrastructure that will benefit the communities in which we operate is important when evaluating the returns from renewable energy projects.

Renewable energy projects are not new to Iamgold. In 2014 we built a 5 MW solar power plant at our Rosebel gold mine in Suriname. It is the country's first renewable source of energy, and when we're gone it will be left for the people of Suriname.

We are now eager to embark on a second solar power project at Essakane, but on a much larger scale. The plan is to have a 15 MW solar power plant financed, developed, operated and owned by a private renewable energy company experienced in building solar energy projects in Africa.

The integration of a solar plant with our existing 57 MW thermal power plant would make this the largest hybrid project in West Africa, if not in the world.

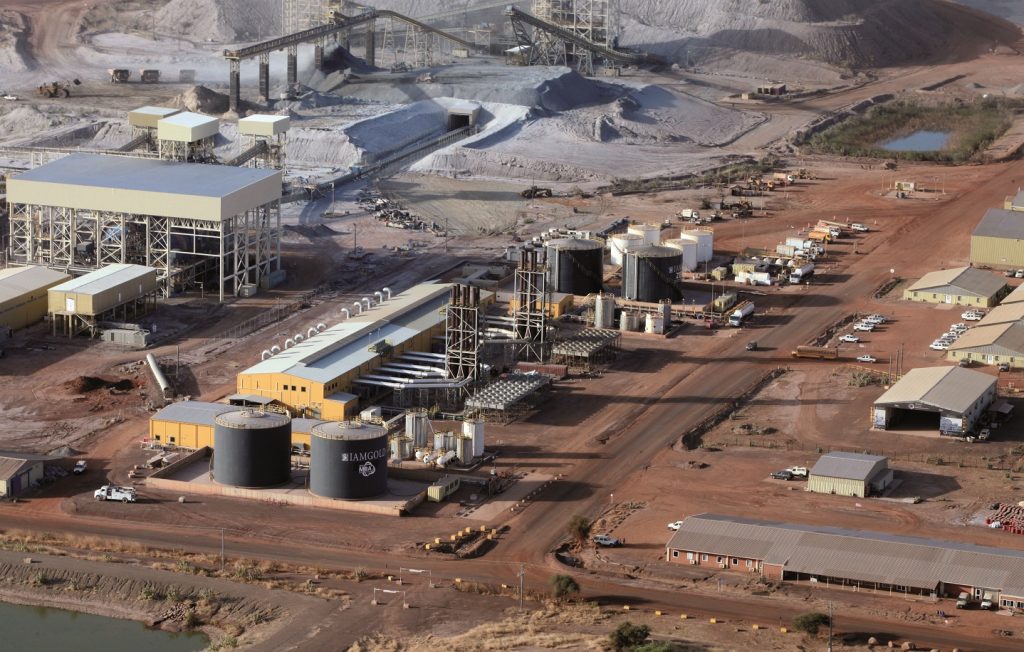

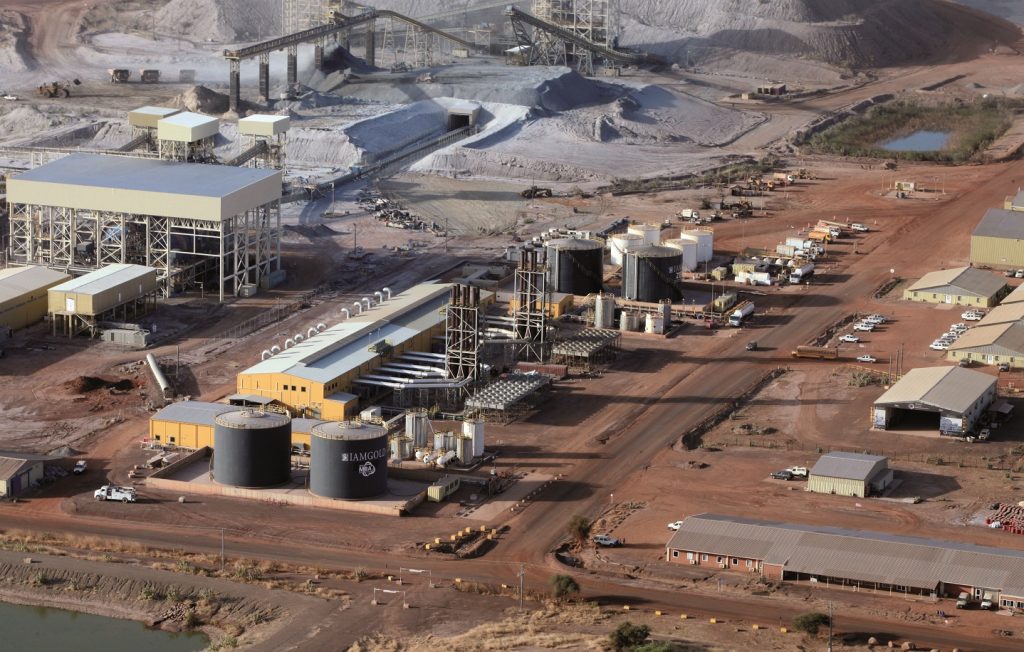

In production for six years, Essakane is our largest gold mine, expected to produce between 365,000 and 375,000 oz. gold in 2016. Based on current reserves and resources, we expect production to continue through to 2025.

Two production lines, primary and secondary crushers, semi-autogenous grinding (SAG) and ball mills and leach tanks run 24 hours a day, seven days a week, to process more than 12 million tonnes of ore a year. The thermal power plant consists of 11 generators which operate on HFO that is trucked to the site from the nearby countries of Benin and Togo.

The mining fleet — comprising 30 haul trucks, 13 drill rigs, 9 loading units and an ancillary fleet of 25, including bulldozers and excavators — is powered by diesel, or light fuel oil, that is also trucked to the site.

The deeper we mine in the pit, the higher the proportion of hard rock. In 2012, the percentage of hard rock in the ore mix was less than 10%. We're mining little soft rock today and expect hard rock to account for nearly 100% of the mill feed in 2017. This is based on current mine plan estimates, so it could change somewhat as exploration at Essakane succeeds in securing sources of soft rock within the vicinity of the Essakane mill.

To accommodate an increasing proportion of hard rock, Essakane underwent a major expansion from 2012 to 2013. The power plant was expanded, a new pre-crushing circuit and ore handling system were added, along with a new SAG mill, ball mill and leach tanks.

As the amount of hard rock in the mill feed increases, so does the demand for energy. Hard rock can take three to four times more power to crush and grind than soft rock.

The 57 MW thermal power plant at Iamgold's Essakane gold mine in Burkina Faso. The plant consists of 11 generators which operate on heavy fuel oil trucked in from Benin and Togo. Credit: Iamgold.

The high energy costs associated with processing an increasing proportion of hard rock has been a challenge for Essakane. When oil was in the US$100 a barrel range in the early part of the decade, HFO power costs accounted for about 25% of Essakane's direct operating costs. The drop in the oil price together with a more favourable exchange rate brought this down to 17% in 2015 and closer to 14% in late 2016. While Essakane's power costs have been as high as US$0.30 per kilowatt hour in the past five years, we're paying closer to US$0.19 today.

While lower oil prices have allowed us to negotiate a reduction in the price we pay for HFO, the government controls the price, so the full impact is not immediately passed on to us, in the same way that we don't see the full impact of lower fuel prices at the pump. Despite the lower price we pay today our view is that oil prices inevitably will increase over time.

Lower cost options

For several years we have been considering alternative energy options to reduce costs at our mines.

One option was connecting Essakane to the national power grid. However, that would have required the construction of a 330-km transmission line, which in 2013 was estimated to have a price tag of more than US$125 million to build. In addition to a significant capital outlay being a deterrent, we would not have moved forward anyway unless we were guaranteed an uninterrupted power supply along with price stability. In a country with a severe power shortage, this option had obvious drawbacks.

One option was connecting Essakane to the national power grid. However, that would have required the construction of a 330-km transmission line, which in 2013 was estimated to have a price tag of more than US$125 million to build. In addition to a significant capital outlay being a deterrent, we would not have moved forward anyway unless we were guaranteed an uninterrupted power supply along with price stability. In a country with a severe power shortage, this option had obvious drawbacks.

Another option was supplementing fuel-based generators with solar energy. Having already built and commissioned a solar power plant at Rosebel, solar energy was not new to us. Generating power from solar is highly affordable as technological advancements have brought down installation and operating costs significantly, allowing for mainstream adoption at an industrial level.

The costs of silicon photo-voltaic cells have fallen dramatically over the past 40 years from US$77 a watt to as low as US$0.30 a watt in 2015. Costs will fluctuate somewhat with supply and demand, but costs are still extremely affordable and expected to continue falling over time.

While the project at Rosebel was on a scale we could manage internally, and was built by our own engineering and construction group, we were contemplating a solar project on a much larger scale for Essakane of at least three times the size. In addition, while the solar plant at Rosebel cost less than US$12 million to build, we knew that a project three times the size would cost at least three times that amount given Essakane's remote location.

So we decided to take a different approach.

Partnership

What we wanted was a renewable energy partner who would put up the capital, build and operate the plant and sell us the power.

That led to an extensive review process beginning in 2015 for the selection of a partner experienced in building solar projects in Africa. Today, we are in negotiations with such a partner about moving forward with this project.

With our 57 MW thermal power plant already in operation, a hybrid would be the perfect solution for Essakane. The power generated from solar would augment the power generated from HFO.

But because energy produced from solar is intermittent, relying solely on renewables would result in power interruptions, which are unmanageable for a continuous operation.

We need to have an integrated power system that would not compromise the reliability of our power supply.

Therefore, plant size would be critical.

A feasibility study determined that a 15 MW plant would be the optimum size for this project.

Once built, the plant will employ an automated energy management system that will ensure optimal interaction with our existing thermal power plant. By providing real time data of the interface between the solar plant and the thermal plant, we will be able to maximize solar consumption and optimize fuel savings.

With the advances in battery technology and their declining costs, we would also evaluate the potential for energy storage in the future.

We would have a long-term power purchasing agreement with our partner under which the electricity produced by the solar plant would be sold to Essakane, with the option to terminate after nine years.

In the initial year we might pay US$0.17 a kilowatt hour with a set rate of escalation in subsequent years. Over nine years the rate could average US$0.18 a kilowatt hour. If we were to mine Essakane beyond 15 years, the power rate would drop significantly, reflecting the payback in the earlier years. So this is how such an arrangement might work.

With investments in solar no longer as technically or financially risky as they once were, arrangements like this where the renewable energy company pays the upfront capital costs and sells the power to its customer are becoming more common.

Benefits

The benefits of integrating solar power with thermal power fall into three main categories:

Reduced costs — We would pay less on a per kilowatt hour basis. For many years Essakane's thermal power costs were in the US$0.30 range, although they're running closer to US$0.19 a kWh today with the lower oil prices. If solar costs averaged just over US$0.18 a kWh for the first nine years, that would be a significant reduction from what we had been paying for many years. Obviously, the lower oil prices mean we will enjoy less cost savings than we would in a higher oil price environment, but as oil prices rise in the future so will the savings.

Reduced carbon emissions — The energy provided by solar would displace about 6 million litres of fuel annually, or 90 million litres over 15 years. By not burning 90 million litres of fuel, Essakane's carbon emissions will be reduced by 255,000 tonnes over 15 years. And this number does not include all of the fuel burned just trucking HFO to the Essakane site.

Socio-economic contribution — This project could also add to the already significant contribution we make to the economy of Burkina Faso as the country's largest private sector employer. The construction and operation of the solar plant will create local jobs. During construction we could see upwards of 120 new local jobs created followed by potentially 40 or more once in operation.

As well, 1% of our revenue at Essakane goes towards community development projects, so 1% of our partner's revenue from selling us solar power could be directed in the same manner.

The benefits of building a solar plant are many, not to mention that it would be our legacy long after we're gone. In a region with a poor power infrastructure, it would give people access to a clean and reliable source of energy, potentially propelling their communities to new heights in their quest to develop other industries long after the mine is closed.

The challenge at our Essakane mine has been higher power costs associated with processing a greater amount of hard rock. The solution, without compromising the reliability of our power supply, is to integrate solar energy with thermal power.

Longer term

Iamgold is targeting to have 15% of its power generated from renewables within the next 2-3 years. This doesn't include Rosebel's power supply from hydro-generated grid electricity. We already have a solar plant at Rosebel capable of generating power for 18 more years, and now we are looking at one three times the size for Essakane.

At our Sadiola mine in Mali, our plan is to move ahead with an expansion that would add 10 years to the mine life. With an uninterrupted supply of low-cost power critical, renewable energy could also be something we look at there.

A hybrid power solution is perfect for Essakane, and I expect that more and more we're going to see the pendulum swing towards hybrid power solutions for any operations anywhere in the world that require continuous base-load power 24/7.

And as developments in energy storage continue to advance, it's only a matter of time before renewables account for a much larger share of the energy mix. Energy storage capability bridges the gap when the sun is not shining and the wind is not blowing.

More companies today are powering their entire operations with renewables. Mining, though, is a power-intensive operation unlike the Ikeas, Googles and Teslas of the world, but I believe that our time will come.

— Stephen J.J. Letwin has been president and CEO of Toronto-based gold miner IAMGOLD since 2010. Prior to joining Iamgold, he held senior positions at Enbridge, TransCanada Energy, TransCanada Pipelines, Numac (Westcoast Energy), and Encor Energy. He holds an MBA from the University of Windsor, is a Certified General Accountant, a graduate of McMaster University (B.Sc., Honors), and a graduate of the Harvard Advanced Management Program.

— Stephen J.J. Letwin has been president and CEO of Toronto-based gold miner IAMGOLD since 2010. Prior to joining Iamgold, he held senior positions at Enbridge, TransCanada Energy, TransCanada Pipelines, Numac (Westcoast Energy), and Encor Energy. He holds an MBA from the University of Windsor, is a Certified General Accountant, a graduate of McMaster University (B.Sc., Honors), and a graduate of the Harvard Advanced Management Program.

For more information on Iamgold's hybrid power programs, please contact: Anthony Moreau, CFA, special projects & innovation manager at IAMGOLD, at tel. 1-416-594-2879 and Anthony_Moreau@IAMGOLD.com

No comments:

Post a Comment

Commented on

The Pangea Advisors Blog

Pangea on X