Evergrande currently has $305 billion in debts outstanding. If it implodes, will it be China's Lehman moment?

Here are some metrics on its size:

- Evergrande owns more than 1,300 real estate projects in over 280 cities in China.

- Its property services management arm is involved in nearly 2,800 projects across more than 310 cities in China.

- The firm says it has 200,000 employees, but indirectly creates more than 3.8 million jobs every year, according to its website.

- In an August report, S&P estimated that over the next 12 months, Evergrande will have over 240 billion yuan ($37.16 billion) of bills and trade payables from contractors to settle — around 100 billion yuan of that amount is due this year.

- in a filing, Shanghai-listed Skshu Paint, a paint supplier to Evergrande, said that the real estate firm repaid part of its debt in properties – and uncompleted ones at that.

From this CNBC report.

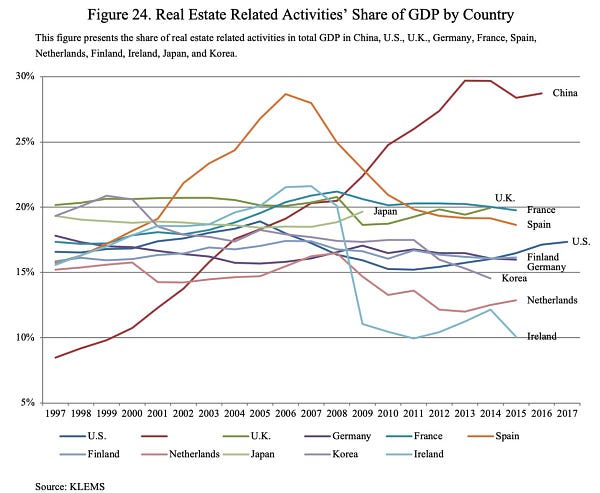

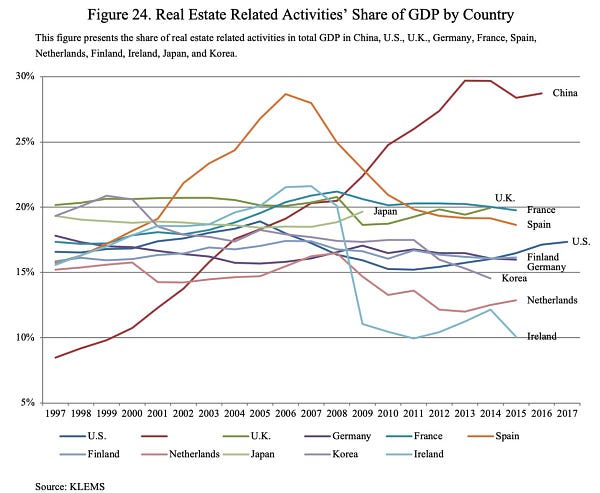

The real worry going forward may be less the risk of an acute financial crisis, than the impact on the real estate sector as a whole, which according to some calculations accounts for as much as 28 percent of Chinese economic activity.

@ChinaBeigeBook The real risk is to the Chinese Economic Model, not to the State-centric banking system. Despite all pronouncements over the past decade, China is more dependent on real estate (in all forms) than before Xi arrived.

What's for sure, is that for the rest of the economy and the world at large, it is not so much Evergrade's collapse per se, but the resulting contagion that may very well spread—in China and beyond— that matters.

According to SCMP, Evergrande's major China investors are already bailing out.

One thing is clear. No one in the markets is really surprised by what is happening. This crisis has been a while in the making.

China's financial markets are closed on Monday and Tuesday 20-21 September. But as Bloomberg reports, Evergrande's inability to service its debts will likely become apparent on Monday.

See the post from Adam Stooze to read more on the travails of Evergrande here: https://adamtooze.substack.com/p/adam-toozes-top-links-is-evergrande

bit.ly/PangeaBlog

No comments:

Post a Comment

Commented on

The Pangea Advisors Blog

Pangea on X