MasterMetals Headlines

Follow us on Twitter

Saturday, December 14, 2019

$GDXJ #Gold #Mining #ETF Rebalance Update for Q4

https://economicalpha.blog/2019/12/13/gdxj-rebalance-update-for-q4/

Wednesday, November 27, 2019

Feds target #Venezuelan brothers in new $4.5 BILLION #MoneyLaundering probe

Pangea on Twitter

A Whole Lot of #Debt: $69 Trillion of World Debt in One #Infographic

The Regional Breakdown

| Region | Debt to GDP | Gross Debt (Millions of USD) | % of Total World Debt |

|---|---|---|---|

| World | 81.8% | $69,298 | 100.0% |

| Asia and Pacific | 79.8% | $24,120 | 34.8% |

| North America | 100.4% | $23,710 | 34.2% |

| Europe | 74.2% | $16,225 | 23.4% |

| South America | 75.0% | $2,699 | 3.9% |

| Africa | 56.9% | $1,313 | 1.9% |

| Other | 37.1% | $1,231 | 1.8% |

World Debt by Country

| Rank | Country | Debt to GDP | Gross Debt ($B) | % of World Total |

|---|---|---|---|---|

| #1 | 🇺🇸 United States | 104.3% | $21,465 | 31.0% |

| #2 | 🇯🇵 Japan | 237.1% | $11,788 | 17.0% |

| #3 | 🇨🇳 China, People's Republic of | 50.6% | $6,764 | 9.8% |

| #4 | 🇮🇹 Italy | 132.2% | $2,744 | 4.0% |

| #5 | 🇫🇷 France | 98.4% | $2,736 | 3.9% |

| #6 | 🇬🇧 United Kingdom | 86.8% | $2,455 | 3.5% |

| #7 | 🇩🇪 Germany | 61.7% | $2,438 | 3.5% |

| #8 | 🇮🇳 India | 68.1% | $1,851 | 2.7% |

| #9 | 🇧🇷 Brazil | 87.9% | $1,642 | 2.4% |

| #10 | 🇨🇦 Canada | 89.9% | $1,540 | 2.2% |

________________________

Monday, November 25, 2019

Unauthorized @Uber drivers in #London conducted 14,000 trips using other drivers' accounts, using unregistered, uninsured vehicles

| ||||||||||||||||||||||||||||||||||||||||||||

Wednesday, November 6, 2019

#Ion: The #FinancialData Group Taking on Bloomberg...and Tons of #Debt

Friday, October 18, 2019

Aleks Svetski,”#Bitcoin is all about #Money” with @APompliano

Tuesday, October 15, 2019

Swiss Bank CBH Keeps Cropping Up in Venezuelan Corruption Cases - Bloomberg

Wednesday, October 2, 2019

#WeWork: At What Point Does #Malfeasance Become #Fraud? Neumann fired? My God, he got on the last helicopter out of Saigon…

« The real toll is that there's somewhere between 5,000 and 15,000 WeWork employees who took a job and a big part of their compensation — the reason they took these jobs was because of equity value. And it's impossible not to count your money 30 days out from an IPO…

« We're probably talking about several thousand people who were going to be millionaires. Now most of them are probably thinking that in the next 30 days there's a one-in-two chance I don't have health insurance. »

« Adam Neumann fired? My God, he got on the last helicopter out of Saigon. »

Read the whole article in the New Yorker Magazine:

Tuesday, October 1, 2019

Potential #WeWork #Bankruptcy Would Mean A Rude Awakening for Commercial #RealEstate Sector

This from zerohedge:

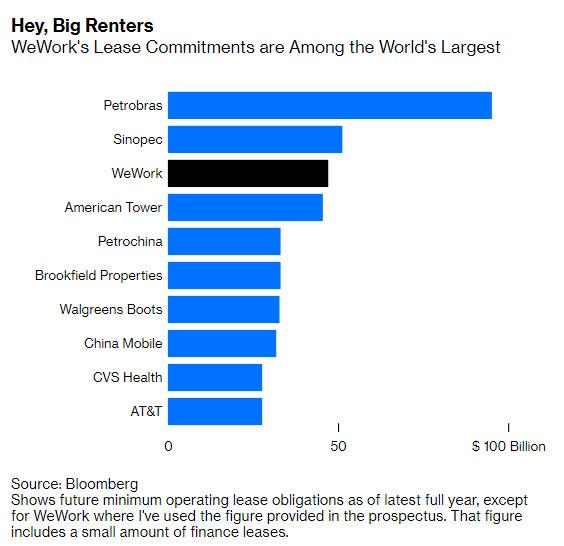

as part of its tremendous growth, by the end of 2019 WeWork will have not only burned $6 billion since 2016, but will have accrued $47 billion of future rent payments due in the form of lease liabilities. On average it leases its buildings for 15 years. Yet as Bloomberg reported previously, its tenants are committed to paying only $4 billion, and on average have leases for 15 months.

in short, a WeWork solvency crisis (read: bankruptcy) would send a shockwave across the US Commercial Real Estate market. Correction, it would send a shockwave across the global commercial real estate market. The reason is that with over $47 billion in lease liabilities, WeWork is already one of the world's largest lessees, trailing only oil exploration giants Petrobras and Sinpec, an astonishing feat for the flexible office space provider "which was founded less than a decade ago, bleeds cash, and doesn't plan to become profitable any time soon."

And then there is the not so subtle fact that WeWork is already the single biggest tenant in New York City, as well as Chicago, Denver and central London.

Said otherwise, a WeWork insolvency would send the Commercial Real Estate market in New York, London, and most major metropolises into a tailspin.

See the whole article here: https://www.zerohedge.com/economics/here-are-billions-loans-exposed-potential-wework-bankruptcy

Wednesday, September 25, 2019

#FamilyOffices Stockpiling Cash as Recession Fears Grow

- About 42% of family offices say they're raising cash reserves

-

Majority surveyed by UBS expect a global recession by 2020

- Family offices are also increasingly focused on a different kind of potential disruption: succession planning. This year, 54% of those surveyed said they have a succession plan in place, up from 43% last year.

Thursday, September 19, 2019

Eric #Sprott’s Investment Spree in #Gold & #Silver #JuniorMining Co.’s Continues

Oreninc published an update to Eric Sprott’s investment spree in the junior mining space.

He’s invested another C$69.3 million in August and September to bump his total to $176.7 million.

Tuesday, September 17, 2019

In Q2, 24% of all the $$ raised by #JuniorMining Co’s—and more than 80% raised by #Gold co’s—came from Eric #Sprott!!

Friday, September 13, 2019

85% of the Global #Bitcoins Supply Has Already Been Mined

As of August 2019, 10 years after its "Genesis", 85% of the Bitcoin supply is already in circulation.

As of August 2019, 10 years after its "Genesis", 85% of the Bitcoin supply is already in circulation. Monday, September 9, 2019

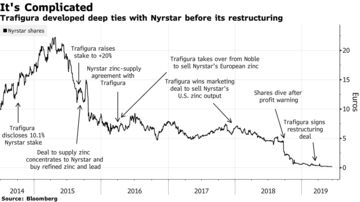

#Trafigura lawsuit on #Nyrstar shows what everyone knew was true, but didn’t have any proof

See the whole piece here from Andy Hoffmann on Bloomberg:

Trafigura Accused of Throttling Nyrstar With Lopsided Deals