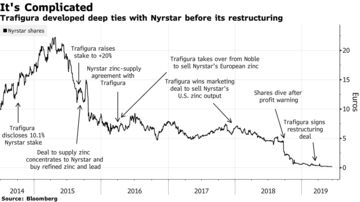

- Contracts "confirmed our main suspicion, which was that Trafigura was in a position to exploit or make an abuse of its economic control," said Laurent Arnauts, a lawyer who said he's representing about 100 Nyrstar investors.

- Top issues raised by the shareholders' group relate to Contracts that allowed Trafigura to buy finished metal at a significant discount to prevailing spot-market rates and certain clauses the shareholders say give it preference and appear to have put Trafigura at an uncommon advantage

-In Trafigura's Supply Deal for Concentrates, Nyrstar accepted processing fees of $24, far below prevailing industry rates of $147/ton in 2018, putting operating margins under strain, according to an analysis by Kris Vansanten, a shareholder and founder of Quanteus Group.

See the whole piece here from Andy Hoffmann on Bloomberg:

Trafigura Accused of Throttling Nyrstar With Lopsided Deals

No comments:

Post a Comment

Commented on

The Pangea Advisors Blog

Pangea on X