This from zerohedge:

as part of its tremendous growth, by the end of 2019 WeWork will have not only burned $6 billion since 2016, but will have accrued $47 billion of future rent payments due in the form of lease liabilities. On average it leases its buildings for 15 years. Yet as Bloomberg reported previously, its tenants are committed to paying only $4 billion, and on average have leases for 15 months.

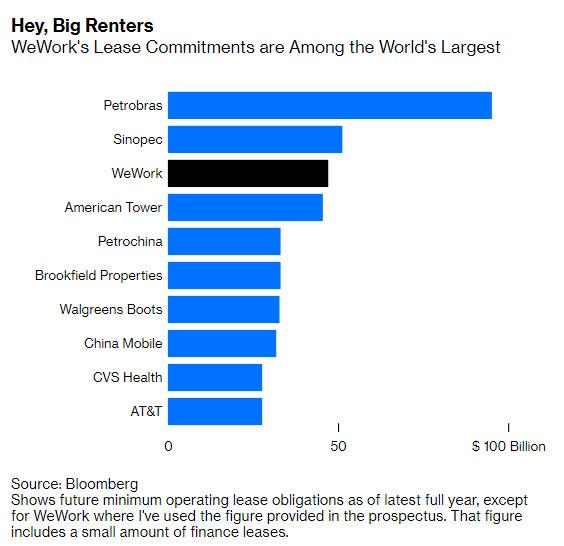

in short, a WeWork solvency crisis (read: bankruptcy) would send a shockwave across the US Commercial Real Estate market. Correction, it would send a shockwave across the global commercial real estate market. The reason is that with over $47 billion in lease liabilities, WeWork is already one of the world's largest lessees, trailing only oil exploration giants Petrobras and Sinpec, an astonishing feat for the flexible office space provider "which was founded less than a decade ago, bleeds cash, and doesn't plan to become profitable any time soon."

And then there is the not so subtle fact that WeWork is already the single biggest tenant in New York City, as well as Chicago, Denver and central London.

Said otherwise, a WeWork insolvency would send the Commercial Real Estate market in New York, London, and most major metropolises into a tailspin.

See the whole article here: https://www.zerohedge.com/economics/here-are-billions-loans-exposed-potential-wework-bankruptcy

No comments:

Post a Comment

Commented on

The Pangea Advisors Blog

Pangea on X