Gold will extend its record-setting rally on "massive currency debasement" and expectations for further stimulus, according to SkyBridge Capital, which recently added exposure to the metal after exiting in 2011.

"When you think of currency debasement the question is, what is the dollar going to weaken against, and when you look around the globe, it's hard to be excited about alternative currencies," said Troy Gayeski, co-chief investment officer and senior portfolio manager, listing the euro, yuan and emerging-market monies. "So, gold is obviously a natural alternative currency."

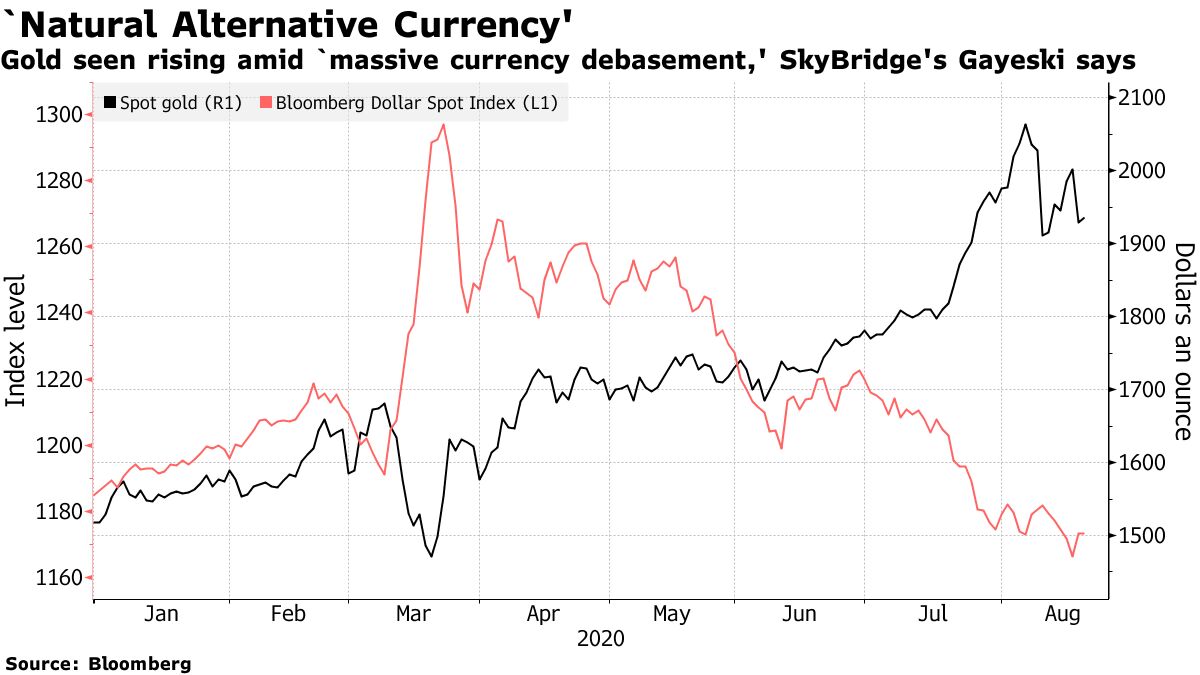

The precious metal surged to a record well above $2,000 an ounce earlier this month -- although prices have stumbled since then -- as central banks including the Federal Reserve unleashed vast stimulus to support economies hurt by the coronavirus pandemic. That's spurred bets that paper currencies will lose their value as money supply jumps. Goldman Sachs Group Inc. calls gold the currency of last resort and has forecast more gains.

Gold is "fairly rich versus oil or other real commodities, but it hasn't appreciated nearly as much as money-supply growth since its previous peak in September of 2011," Gayeski said in an interview. "It wouldn't surprise us if by the end of next year, it's around the $2,100-to-$2,200 range."

Spot gold hit an all-time high of $2,075.47 an ounce on Aug. 7 as the dollar weakened and real interest rates fell well below zero. On Thursday it climbed 0.4% to $1,936, up almost 28% this year. Prices eased midweek after minutes from the Fed showed it edging away from a step that would underscore a commitment to an extended period of ultra-loose policy.

Ultimately, the driver for gold is "you have massive currency debasement, particularly in the U.S.," Gayeski said.

SkyBridge, which manages $7.35 billion, has about 3% exposure to gold, with the majority of positions taken in the past two months. The fund-of-funds manager's primary exposures are to U.S. cash-flow-generative strategies backed by tangible assets, including residential mortgage-backed securities.

While the latest round of fiscal stimulus talks haven't yet yielded a deal, the Fed has already swelled its balance sheet by about $2.8 trillion this year, with Goldman cautioning that U.S. policy is triggering debasement fears.

The Fed will likely ramp up asset purchases, and there's more fiscal stimulus coming too, according to Gayeski. "All those things argue for a continued bull market in gold, again driven principally by money-supply growth and dollar debasement as opposed to real inflation fears," he said. "Furthermore, expect continued asset inflation long before real inflation ever shows up."

See the article on Bloomberg here: https://www.bloomberg.com/news/articles/2020-08-20/gold-will-gain-on-massive-currency-debasement-skybridge-says?

Related coverage and commentary:

No comments:

Post a Comment

Commented on

The Pangea Advisors Blog

Pangea on X