The Board is taking action to assess banks' conditions more intensively and to require the largest banks to adopt prudent measures to preserve capital in the coming months."

Bank stocks are not happy...

Wells Fargo and BofA are the worst hit after hours...

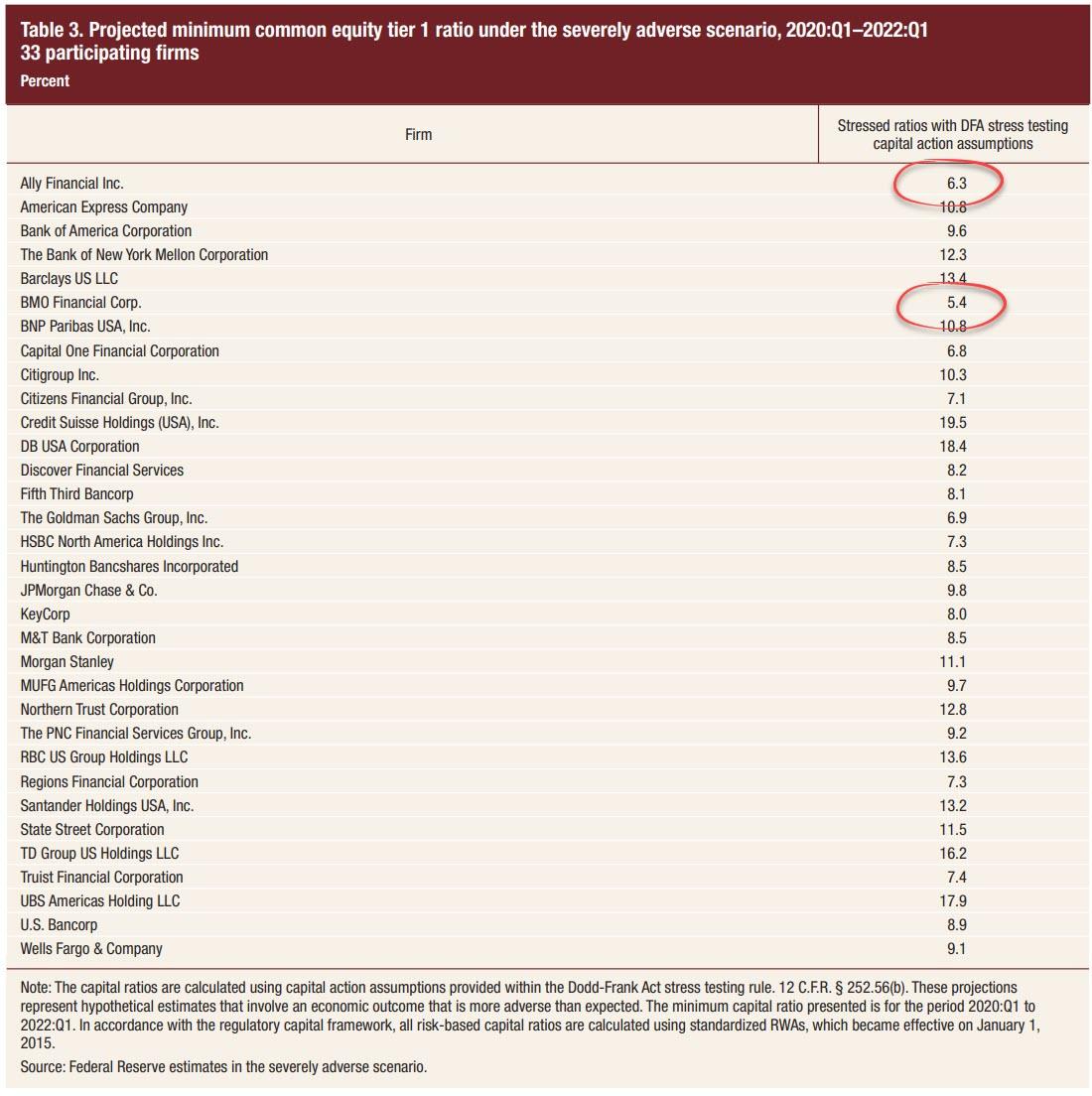

Ally Financial and BMO had the lowest common equity tier 1 ratio in the severely adverse scenario:

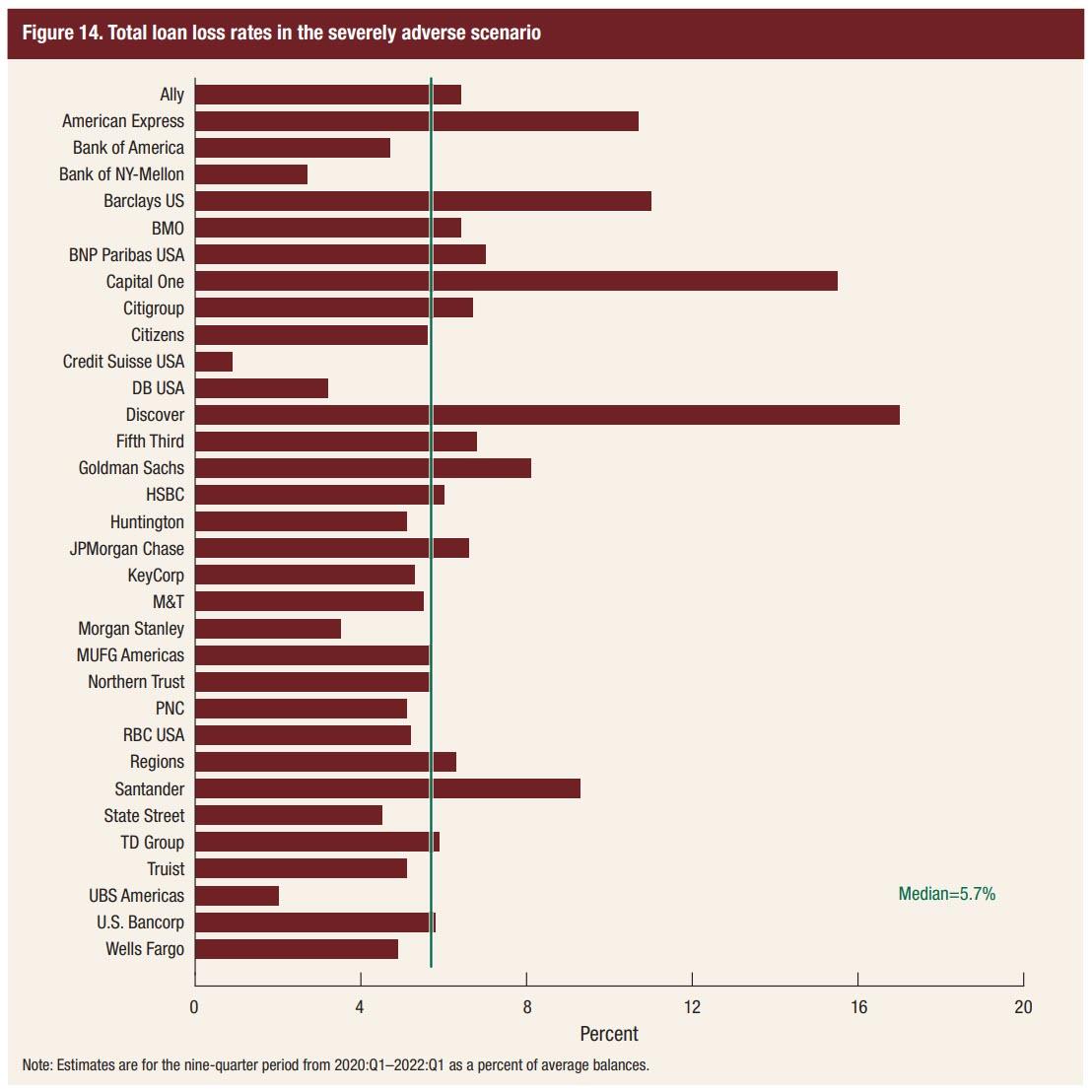

Discover, Capital One, Barclays, and Amex face the biggest loan losses...

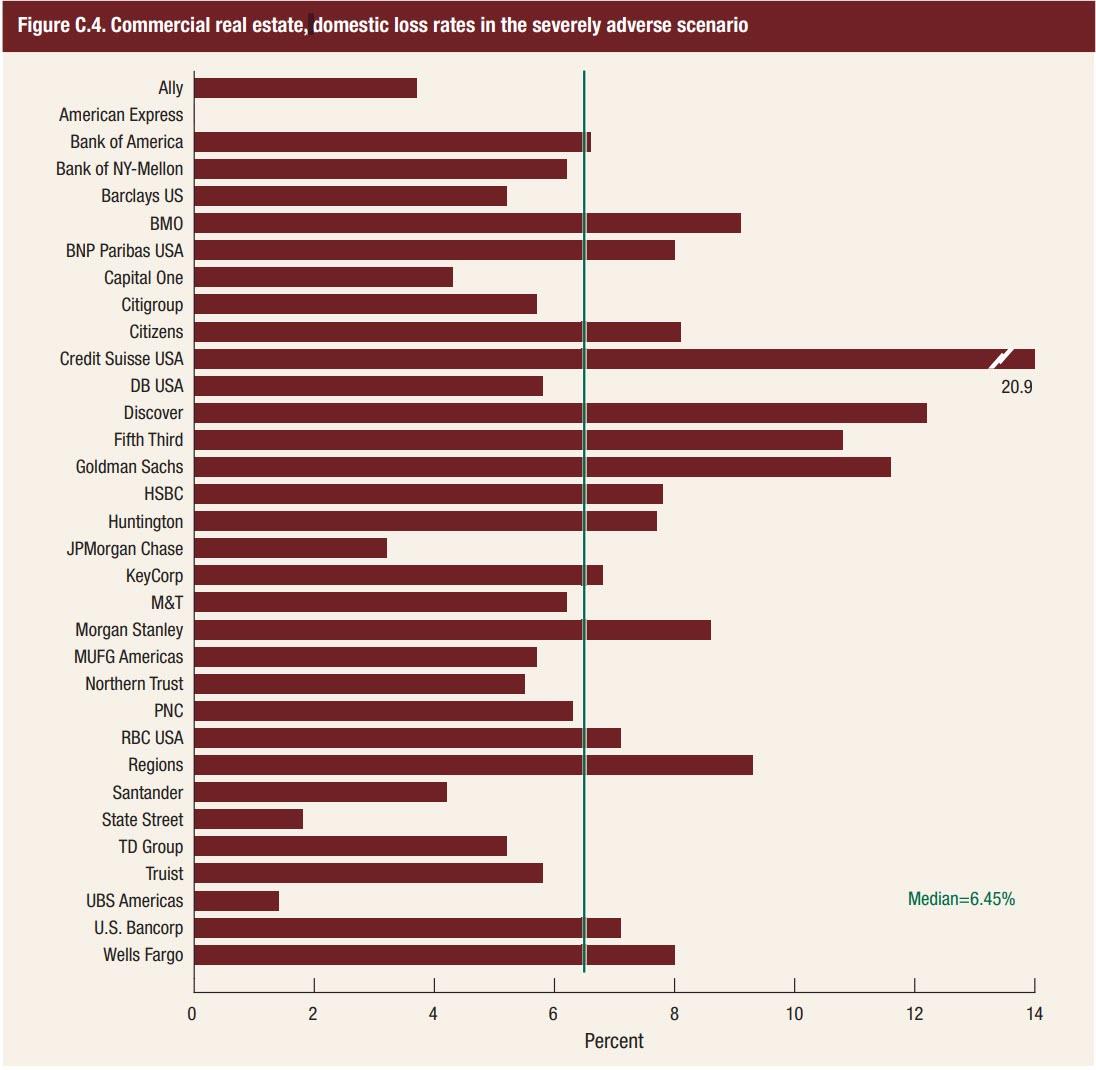

Credit Suisse is the most exposed to losses from Commercial Real Estate...

* * *

So what did the results say?

The Fed said in a release that big banks will be required to suspend share buybacks and cap dividend payments at their current level for the third quarter of this year. The regulator also said that it would only allow dividends to be paid based on a formula tied to a bank's recent earnings.

Furthermore, the industry will be subject to ongoing scrutiny: For the first time in the decade-long history of the stress test, banks will have to resubmit their payout plans again later this year.

"While I expect banks will continue to manage their capital actions and liquidity risk prudently, and in support of the real economy, there is material uncertainty about the trajectory for the economic recovery," Fed Vice Chair Randall Quarles said in a statement.

The Federal Reserve Board on Thursday released the results of its stress tests for 2020 and additional sensitivity analyses that the Board conducted in light of the coronavirus event.

"The banking system has been a source of strength during this crisis," Vice Chair Randal K. Quarles said, "and the results of our sensitivity analyses show that our banks can remain strong in the face of even the harshest shocks."

In addition to its normal stress test, the Board conducted a sensitivity analysis to assess the resiliency of large banks under three hypothetical recessions, or downside scenarios, which could result from the coronavirus event. The scenarios included a V-shaped recession and recovery; a slower, U-shaped recession and recovery; and a W-shaped, double-dip recession.

Full release From the Fed

See the story on here: https://www.zerohedge.com/markets/us-bank-stocks-sink-fed-caps-dividends-forbids-share-buybacks-stress-tests

No comments:

Post a Comment

Commented on

The Pangea Advisors Blog

Pangea on X