Thread by @RaoulGMI: The Dollar Wrecking Ball: I hear the narratives that the Fed is printing money...Brrr... and that is going to cause a dollar collapse. I wor…"You see, the biggest problem the world faces is the dollar. We are in a viscous doom loop where slowing growth causes the dollar to rise, which causes slower growth, which causes the dollar to rise, as all borrowers play musical chairs to get access to the dollar to service debts"

...

The global system is just not set up to deal with this. It is an UGLY situation with almost zero options without a change in the entire system. No printing of money will solve this. It is structural.

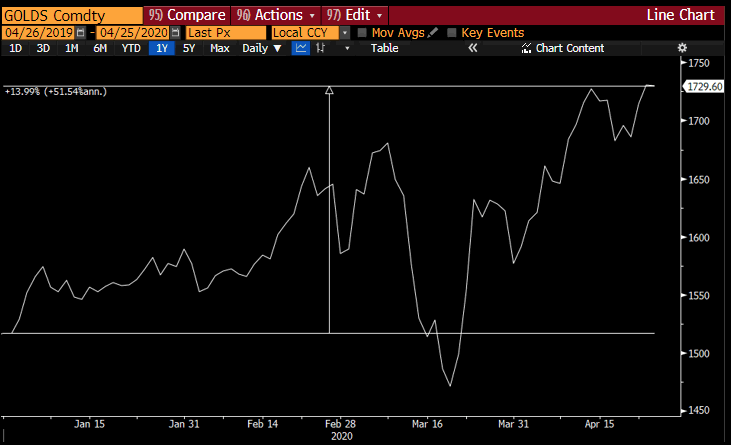

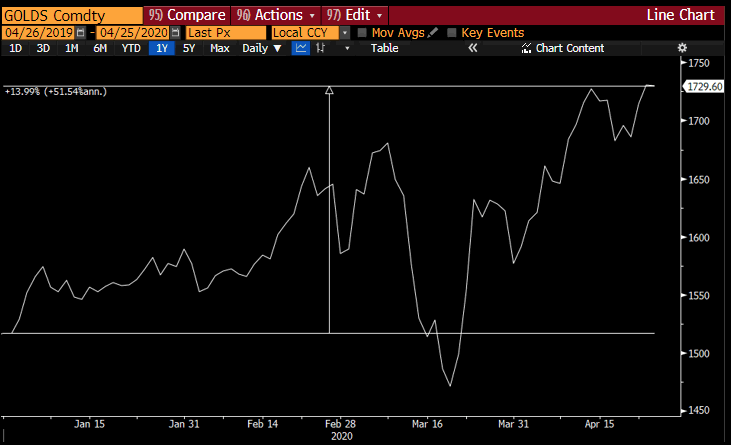

And the change in the system is what gold is picking up (amongst many other things). All attempts to create more money to solve the dollar standard issue tends to devalue all fiat versus gold. Gold is rallying on debt deflation probabilities.

Read this excellent thread by Raoul Pal on why the Dollar won't be collapsing anytime soon...

Thread by @RaoulGMI: The Dollar Wrecking Ball: I hear the narratives that the Fed is printing money...Brrr... and that is going to cause a dollar collapse. I wor…

The Dollar Wrecking Ball:

I hear the narratives that the Fed is printing money...Brrr... and that is going to cause a dollar collapse. I worry that this narrative is very wrong. My strongly held view is that the dollar is the pinnacle of all the macro issues we face. 1/

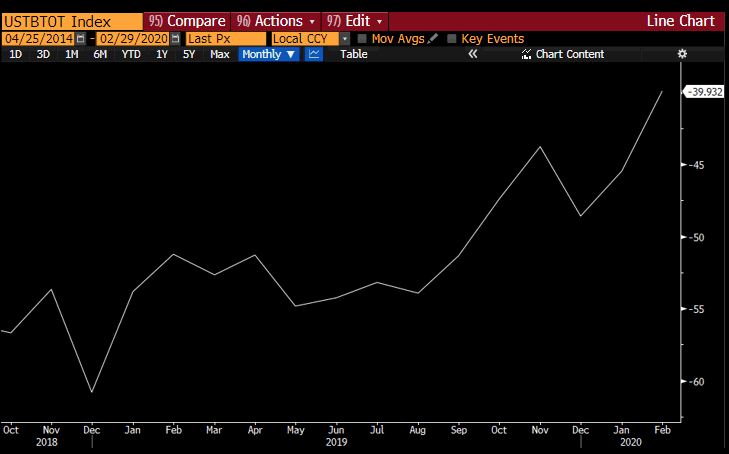

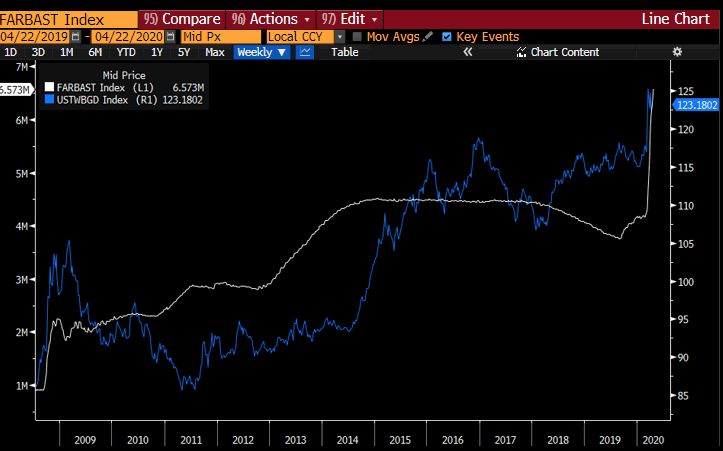

The Fed have undertaken unprecedented printing, as we know, and the balance sheet is growing exponentially.

But it is not that simple. We live in a relative world where the dollar standard is the very cause of many of the issues we now face. There are simply not enough dollars available in the world to service all the debts and thus a debt deflation remains the BIG RISK.

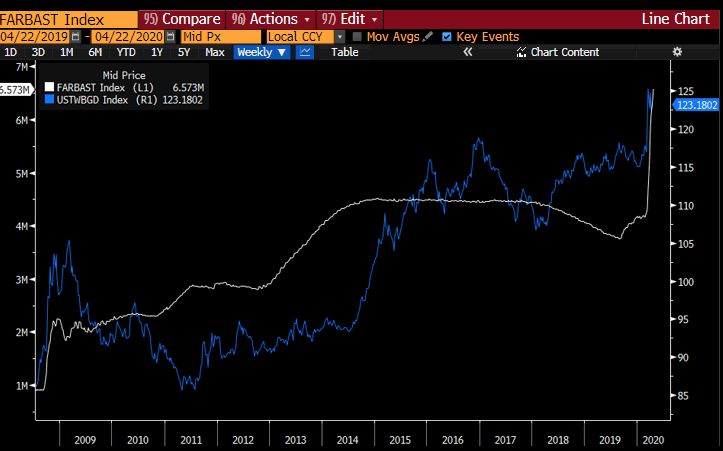

The expansion of the balance sheet is in fact correlated to the rise of the dollar, not the fall. Here is the Fed Broad Trade Weighted Dollar Index versus the Fed balance sheet.

And since last year, when the global slowdown started, the two are joined at the hip...

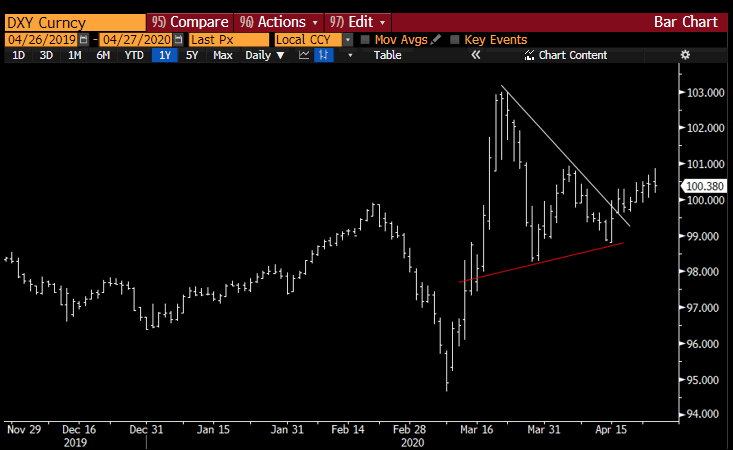

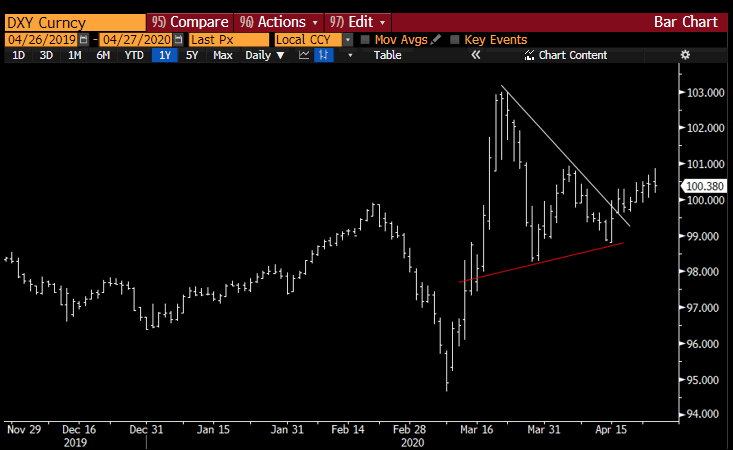

People have been looking at the messy chart of the DXY and have been quick to call the end of the dollar rally.... but to me, the DXY broke a small wedge pattern.

And a break of the 103 high would break the neck line of a large cup and handle pattern....

Which, in turn, would lead to an acceleration phase of the bigger downward sloping wedge break that I have been following for most of the last decade.

The Fed Broad Trade Weighted Dollar Index is even more concerning. It has broken out of a massive cup and handle and is at all time highs and appears to be accelerating... (and this is without the RMB moving much...yet).

The magnitude of this pattern is mind blowing... here is the long-term chart going back to the 1960's.

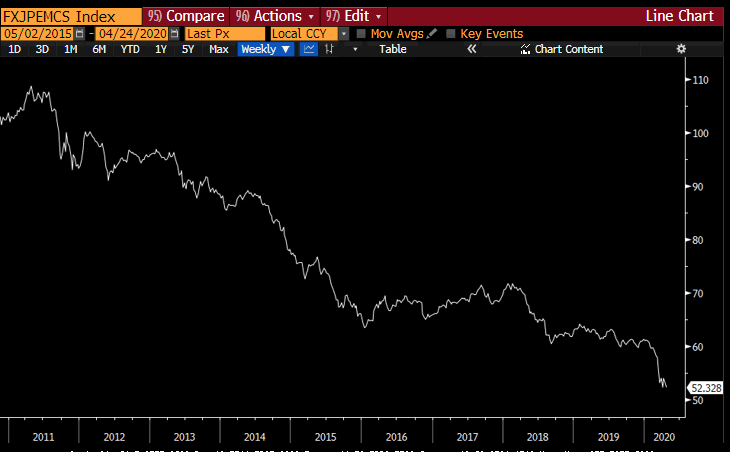

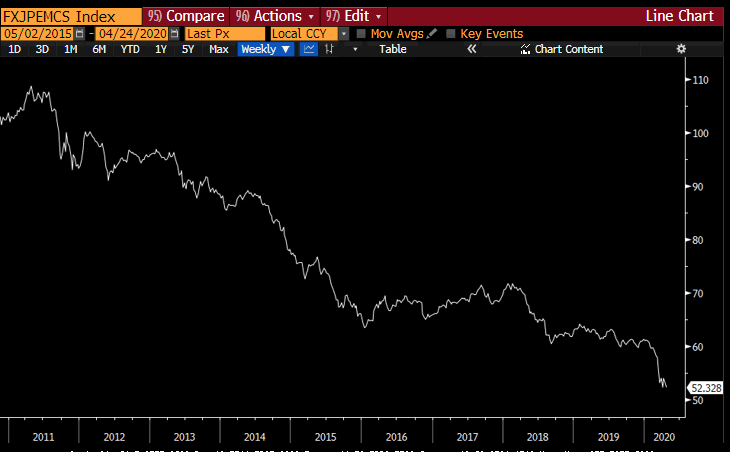

This is matched by the size of the top pattern in the Asian currency index, which is so big that its almost beyond comprehension...

And the short term chart of the ADXY looks like it's about to break lower...again.

But it's not just Asia...the entire Emerging Market FX complex is in FREE FALL...

And that brings us back to velocity of the money that the Fed is printing... it is plummeting and that is crowding out the weakest borrowers, in this case EM FX. This is the very essence of a DEBT DEFLATION.

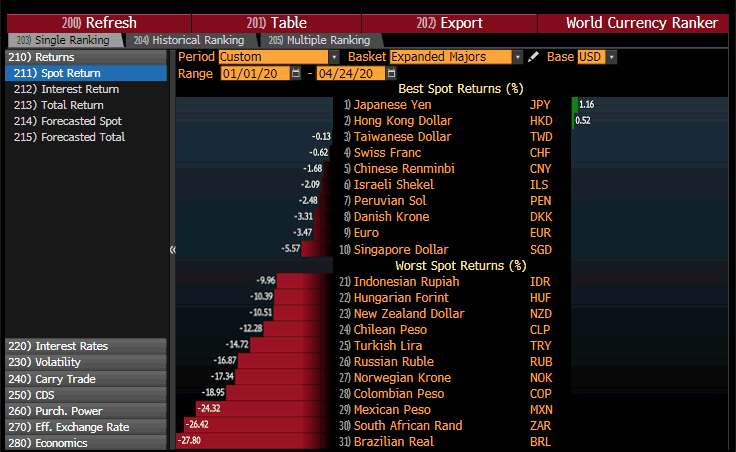

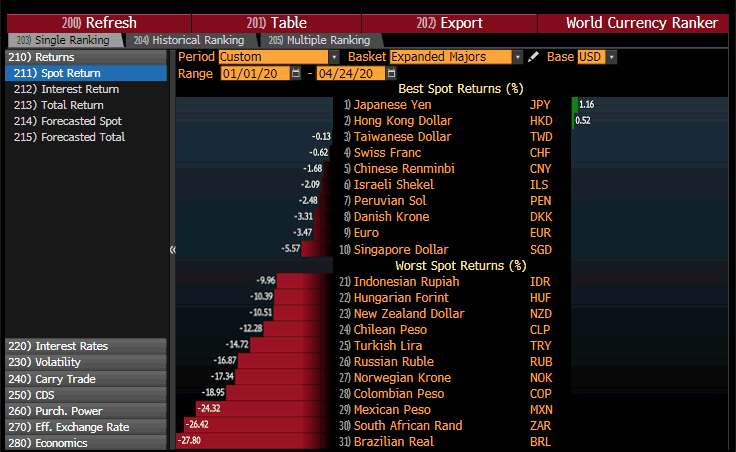

This year alone has been a blood bath of currencies versus the USD.

And since the Fed started "Haha...the money printer goes Brrr.." The situation has gotten no better..

You see, the biggest problem the world faces is the dollar. We are in a viscous doom loop where slowing growth causes the dollar to rise, which causes slower growth, which causes the dollar to rise, as all borrowers play musical chairs to get access to the dollar to service debts

Dollar swap lines, QE, jawboning, etc have done nothing to stop this. Nothing. The issue is here that swap lines cant help the weakest sovereign borrowers as they have no reserves. And the $13trn dollar short is held mainly by corporations, which struggle to get access to dollars

due to the fact that they are suffering massively weakened cash flows from trade tariffs, collapsing commodity prices, slowing world growth and a shrinking US trade deficit... (tariffs, oil and slow growth).

The global system is just not set up to deal with this. It is an UGLY situation with almost zero options without a change in the entire system. No printing of money will solve this. It is structural.

And the change in the system is what gold is picking up (amongst many other things). All attempts to create more money to solve the dollar standard issue tends to devalue all fiat versus gold. Gold is rallying on debt deflation probabilities.

Bitcoin will be part of the equation but has yet to make any serious move against this backdrop. Its time will come...

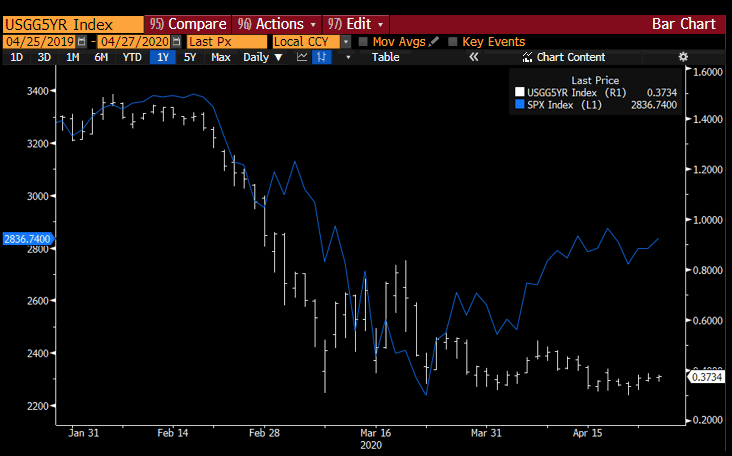

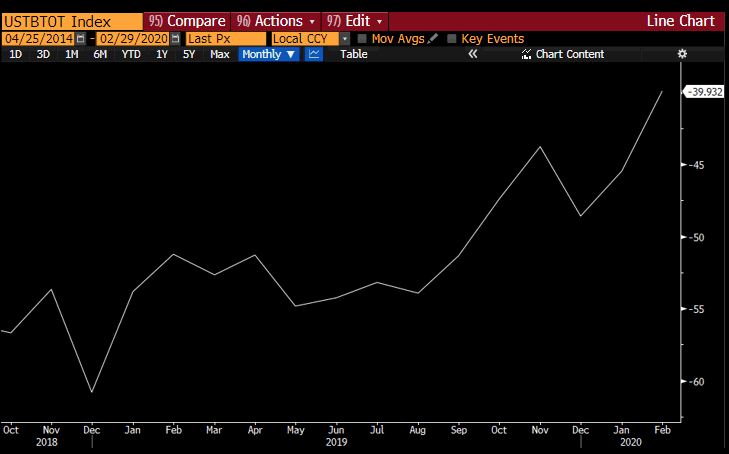

My guess is that the next Debt Deflation signal will come when bonds begin to price in negative interest rates. That day is coming soon...

Here are 2 year yields:

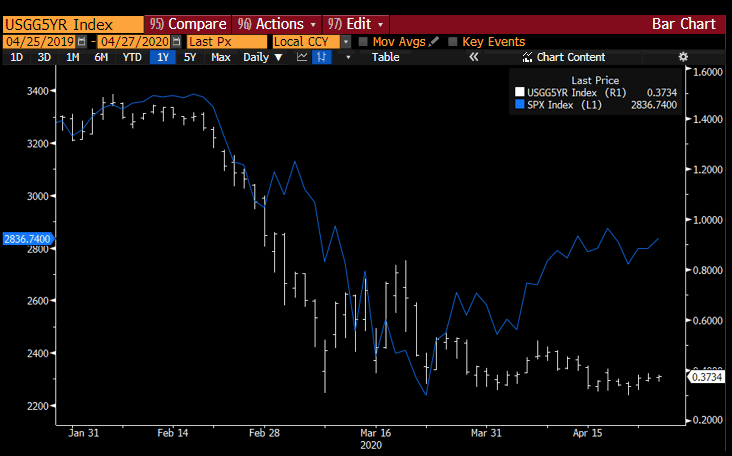

And here are 5 year yields:

And that will be the signal to sell equities and the INSOLVENCY phase will begin.

Correct chart:

Missing chart:

No comments:

Post a Comment

Commented on

The Pangea Advisors Blog

Pangea on X