Decade of Gold Mine Declines Poised to Spur Deals, Prices

Gold’s dwindling pipeline of new mines is poised to usher in a decade-long output slump, spurring prices and delivering a new impetus for dealmaking and industry consolidation, according to Goldcorp Inc., the third-largest gold producer.

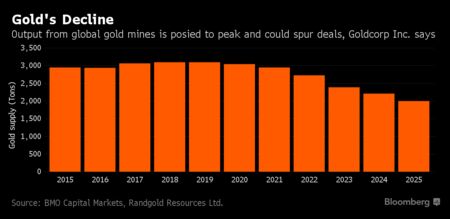

Mine supply may fall about a third in the 10 years to 2025, according to Bloomberg calculations based on forecasts from BMO Capital Markets and Randgold Resources Ltd. The number of newly discovered primary gold deposits fell to three in 2014, from a peak of 37 in 1987, according to Melbourne-based industry adviser MinEx Consulting Pty.

“What we’ll possibly see is consolidation in the industry as a result, whether that’s a large company taking over smaller ones, a number of smaller ones getting together, or even two or three large companies being merged,” Ian Telfer, chairman of Vancouver-based Goldcorp, said in an interview. “No CEO wants to run a shrinking company.”

The number of deals in the gold sector this year is the highest since 2011, as the metal’s price surge has spurred producers to trade assets to add production or to improve the quality of their mine portfolios. Goldcorp is reviewing opportunities for acquisitions or partnerships including in new discoveries and existing assets, both in the Americas and further afield, Telfer said.

...

Gold production may peak in the next three years as miners fail to replace their reserves, Randgold’s Chief Executive Officer Mark Bristow said in September. And, according to Goldcorp’s Telfer, producers have limited scope to raise output in response to higher prices. “We are having a heck of a time finding gold,” he said.

There’s also increasing competition to secure an interest in the best exploration finds by smaller competitors, according to Sandeep Biswas, chief executive officer of Newcrest Mining Ltd., Australia’s biggest producer. Newcrest last month agreed to pay about $22.8 million for a stake in a developer with assets in Ecuador, beating a competing proposal from BHP Billiton Ltd.

Companies facing production declines have a three-to-four year window to expand their resource bases before buying becomes a necessity, BMO analysts including Andrew Kaip wrote in a September note.

...

“Once supply from mines starts to decline and people start to realize the impact that’s going to have, I think it’s going to be incredibly bullish for gold,” Telfer said in the interview last week in Melbourne. “If gold went to $2,500 an ounce tomorrow, Goldcorp’s production wouldn’t change for the next four years. It can’t react to a change.”

‘Risky Business’

A decline in gold mine output may arrive sooner than forecast, though a slowdown in supply will be gradual, Sydney-based Jordan Eliseo, chief economist at gold trader and refiner Australian Bullion Co., said by phone. “It’s not going to plummet overnight,” he said. The availability of recycled gold means the impact on prices may also be limited, Eliseo said.

In the medium term, output from existing mines will drop about 10 percent in the five years to 2020, according to London-based Metals Focus Ltd. While gold finds are brought into production more quickly than copper or nickel discoveries, it still takes an average of 10 years to commercialize new projects, according to MinEx Consulting.

Read the whole article online here :

Decade of Gold Mine Declines Poised to Spur Deals, Prices:

The Pangea Advisors Blog

No comments:

Post a Comment

Commented on

The Pangea Advisors Blog

Pangea on X