MasterMetals Headlines

Follow us on Twitter

Monday, October 29, 2018

.@Fidelity hopes its Trading-Clearing-Custody-#ColdStorage system for #Crypto Assets Will be the #MissingLink to lure Institutional Investors

Friday, October 26, 2018

What do you want? #RenewableEnergy. When do you want it? Now!

100 percent renewables is a wildly popular goal

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13052251/eei_survey_2018_truths.jpg) EEI

EEI :no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13052265/eei_survey_2018_support.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13052261/eei_survey_2018_poll.jpg) EEI

EEI Monday, October 22, 2018

#Blockchain-based #Gold tracking coming to the #LBMA

Blockchain Could Track the Globe's Gold Bullion by 2019

Ethical sourcing is becoming critical in such a high-value sector as precious metals. It will become even more important as reserves of metals such as gold diminish and scarcity develops.

Proving the origins of gold could prevent smuggling from developing countries where mining practices can threaten lives and damage the environment. It ensures that everyone involved in the supply chain, including miners, are rewarded and reassures gold buyers and consumers that both people and the environment are being protected.

The tracking of gold bullion from its origin through its ownership and use cycle could prevent theft. It could also prevent illegal sales, smuggling, and use funding conflict and terrorism. Blockchain technology presents a way to remove illegal or unethical gold from the markets.

Achieving a Credible Blockchain Solution

The LBMA is a global authority on gold and the international trade association for the over-the-counter (OTC) gold bullion market. Its members include the largest gold miners, refiners and traders of gold.

The LBMA asked its members for proposals in March 2018 regarding how to track gold and prevent forgery. According to Reuters reporting, the LBMA received 26 proposals, including pitches from technology startups, and also from IBM. Out of the 26 proposals, 20 incorporated blockchain technology.

The authority will now create a set of standards for services, whilst understanding what a "credible blockchain solution" is, said LBMA's executive board director Sakhila Mirza who added:

Once those have been appropriately established, the result would be a selection of service providers that meet the minimum standards.

Tracking a Trillion Dollar Industry

Selecting service providers is likely to occur in 2019. The successful blockchain developer would be responsible for a system that provides tracking and transparency to a trillion dollar industry.

London is the largest hub in the world for OTC gold trades and clearing. Wholesale gold trades across London's five precious metal clearing banks, overseen by the LBMA, reached a value of $6.7 trillion in 2017.

The estimated implied market capitalization for gold is over $7 trillion. It is an implied capitalization as it includes gold already mined, in circulation, and potentially still in the ground. London's gold vaults contain around 8,000 tonnes of gold bullion, second only to the gold held by the U.S government.

What are your thoughts om blockchain-based gold tracking? Let us know in the comments below!

Monday, October 15, 2018

#Energy traders and banks back new #blockchain platforms

Royal Dutch Shell, Mercuria and Gunvor, and financial institutions such as ING, Société Générale, Citigroup and ABN Amro are backing two new blockchain platforms.

By digitising the large amount of contracts, letters of credit, invoices and other paperwork currently sent around the world by email, fax or post, and putting them on the Ethereum blockchain platform, they are hoping that the new platforms will lead to faster, cheaper and more secure ways of completing a trade as well as settling the transaction

Energy traders and banks back new blockchain platforms

Aim is to provide faster, cheaper and more secure ways of completing trades

A group of the world's leading energy traders and banks is looking to shake up the centuries-old trade finance industry with the launch of two new platforms underpinned by blockchain technology.

Thursday, October 11, 2018

Yale’s endowment invests in #crypto funds

The most influential endowment manager just jumped into crypto with bets on two Silicon Valley funds

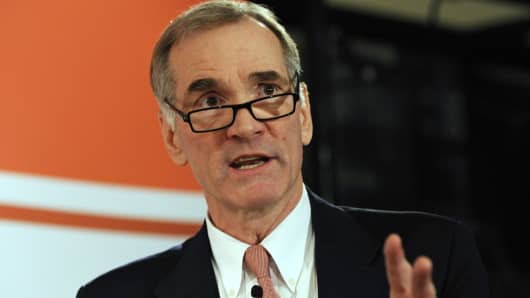

Peter Foley | Bloomberg | Getty Images

David F. Swensen, chief investment officer of the Yale University Investments Office.

David Swensen, who's known as Yale's 'Warren Buffett' because of his investing success with the university's endowment, is making his first big bets on cryptocurrency following the recent swoon in the price of bitcoin and other digital currencies.

Swensen, who is chief investment officer of the university's $29.4 billion endowment, has invested in two venture funds dedicated to cryptocurrency, according to people familiar with the matter.

Friday, October 5, 2018

#Venezuela’s #Refugees Send Billions Back Home, Helping the Lucky Survive - Bloomberg

"Venezuela is moving in the direction of Haiti"

"Oil production has plunged almost two-thirds in the past 16 years, turning the country with the world's biggest proven reserves into a mere fringe player in global markets. Venezuelans, meanwhile, are fleeing in droves. An estimated 1.6 million have left since 2015—roughly 5 percent of the population. The United Nations now estimates that are some 2.3 million Venezuelans living abroad, while in 2005 there were only 437,000.

"This new export is paying dividends. As the Venezuelan diaspora earns ever greater income, they're sending more to struggling relatives back home. Remittances surged to $1.5 billion in 2017 and will climb a further 60 percent this year to $2.4 billion, according to Caracas-based consultancy Ecoanalitica"

https://www.bloomberg.com/news/features/2018-10-02/venezuelan-refugees-send-billions-back-home-helping-the-lucky-survive

Venezuelan Refugees Send Billions Back Home, Helping the Lucky Survive

The transfers, as little as $10 a month, trickle into people's pockets through networks of small businesses and relatives fortunate enough to have a foreign bank account.